THE PAYBACK RULE (PB)

- Payback period: the amount of time required for an investment to generate cash flows sufficient to recover its initial cost.

- A cutoff period is established

- Payback Rule (PB) method usually use with small investment project.

There are two types of cash flows to calculate payback period:

- For annuity

Payback period= initial investment/annual cash inflow

- For non-annuity

Calculate cumulative cash inflows on year to year basis until the initial investment is recovered.

Project Decision:

- if PB period<cutoff period or number of prespecified year=> accept the project.

- if PB period>cutoff period or number of prespecified year => reject the project.

Advantages for Payback Rule

- Easy to understand

- Adjusts for uncertainty of later cash flows.

- Biased towards liquidity

Disadvantages for Payback Rule

- Ignores the time value of money

- Requires an arbitrary cutoff point

- .Ignores cash flows beyond the cutoff date.

- Biased against long-term projects, such as research and development, and new projects

Example 1:

Company invests $1,000 returning an annuity of $244 per year for five year. If a particular cutoff time is three years and assumes that company uses Payback Rule method to evaluate project, is this project taken?

Solution:

Payback period=initial investment/ annual cash flow = 1,000/244=4.1 years

Cutoff time = 3 years

Payback period=4.1> cutoff period=3, so company should reject this project.

Example 2:

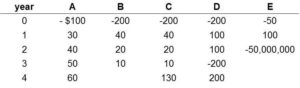

There are five projects to consider for investment chance using Payable Rule.

Assume a particular cutoff time is two year.

- Project A: payback period = 2.6 year because the sum of the cash flows for first two years is $70 and leave $100-$70=$30 and cash flow at third year is $50, so $30/$50=0.6 year

- Project B: it never pays back because the cash flows never total up to the original investment.

- Project C: Payback period=4 year.

- Project D: there are two different payback periods are either 2 year or 4 year. Payback period is calculated doesn’t guarantee a single answer.

- Project E: payback period=six month. It is obviously unrealistic, but it does pay back in six months, thereby illustrating the point that a rapid payback does not guarantee a good investment.

According to payback rule, investor will accept Project D and E and reject Project A,B and C.

Source:

- Phnom Penh HR

- Mcgraw-Hill – Fundamentals Of Corporate Finance