The figures are filled in these tax forms below explained at end of tax forms.

សូមចុចលើរូបភាពខាងក្រោមដើម្បីមើលច្បាស់

Assume we will declare monthly tax for September 2018, so the following steps will fill to submit to tax officer.

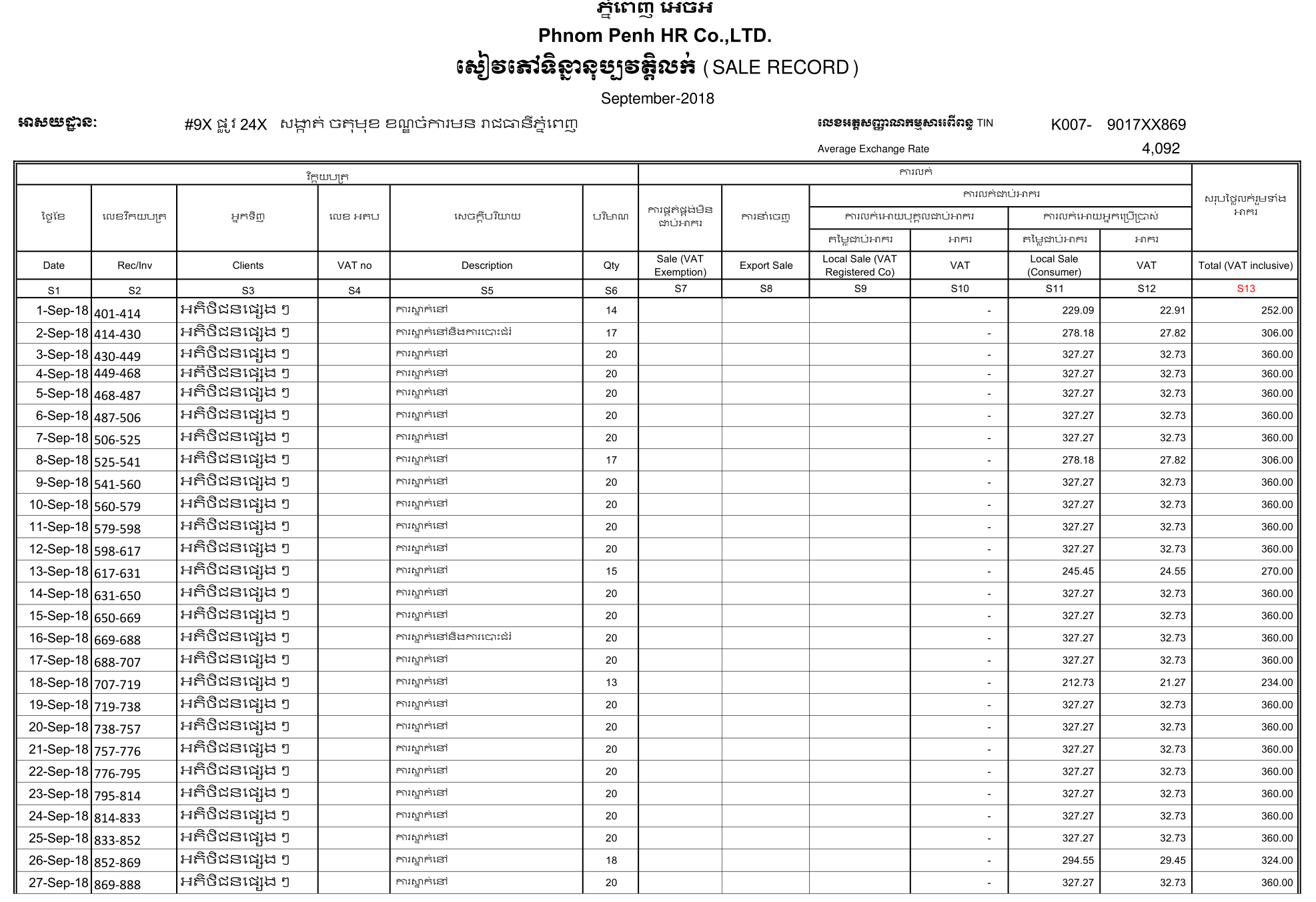

1.We will record sale for September 2018 the same as table below.

Information included Date, Invoice Number, Client (customers), VAT No. , Description, Quantity (Qty) Sold etc.

——

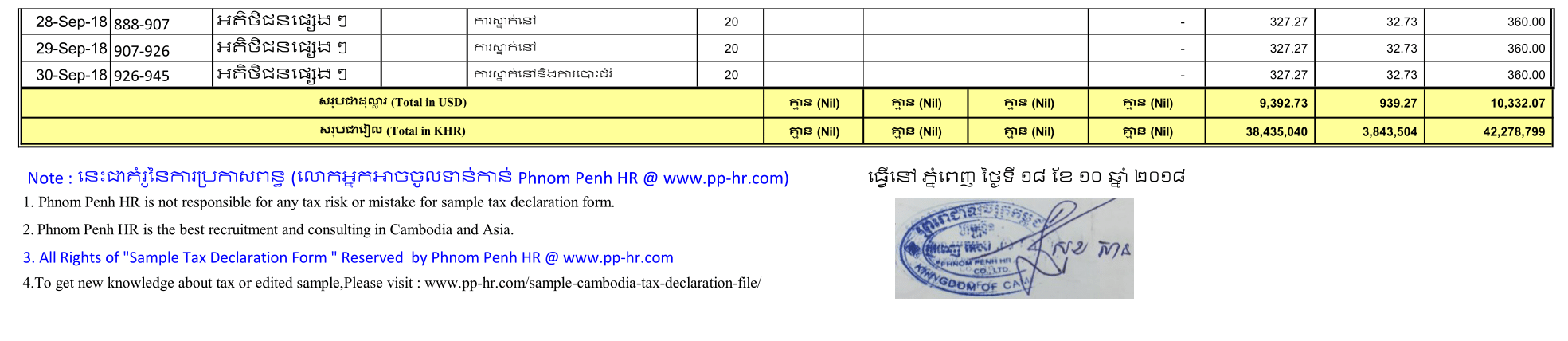

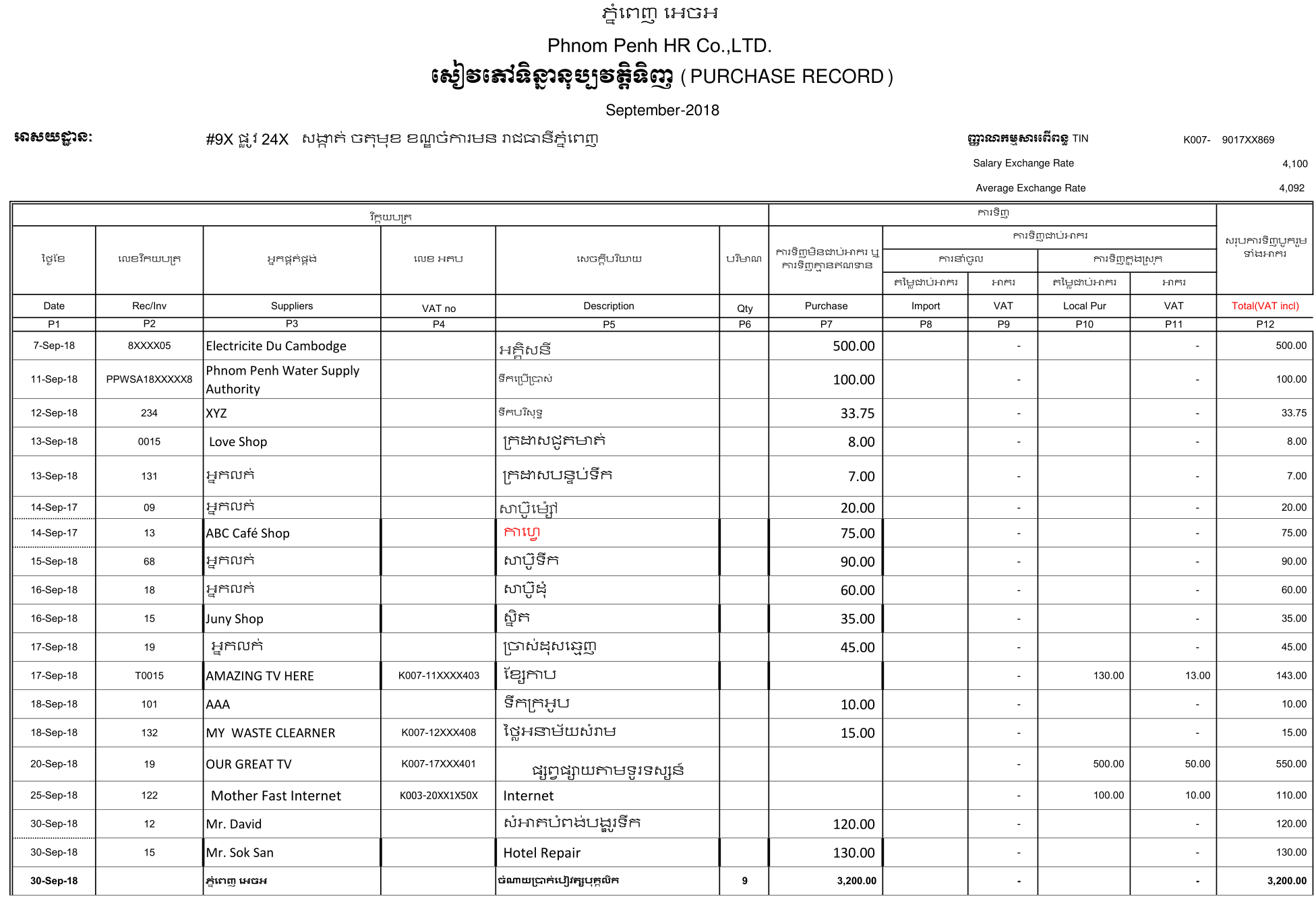

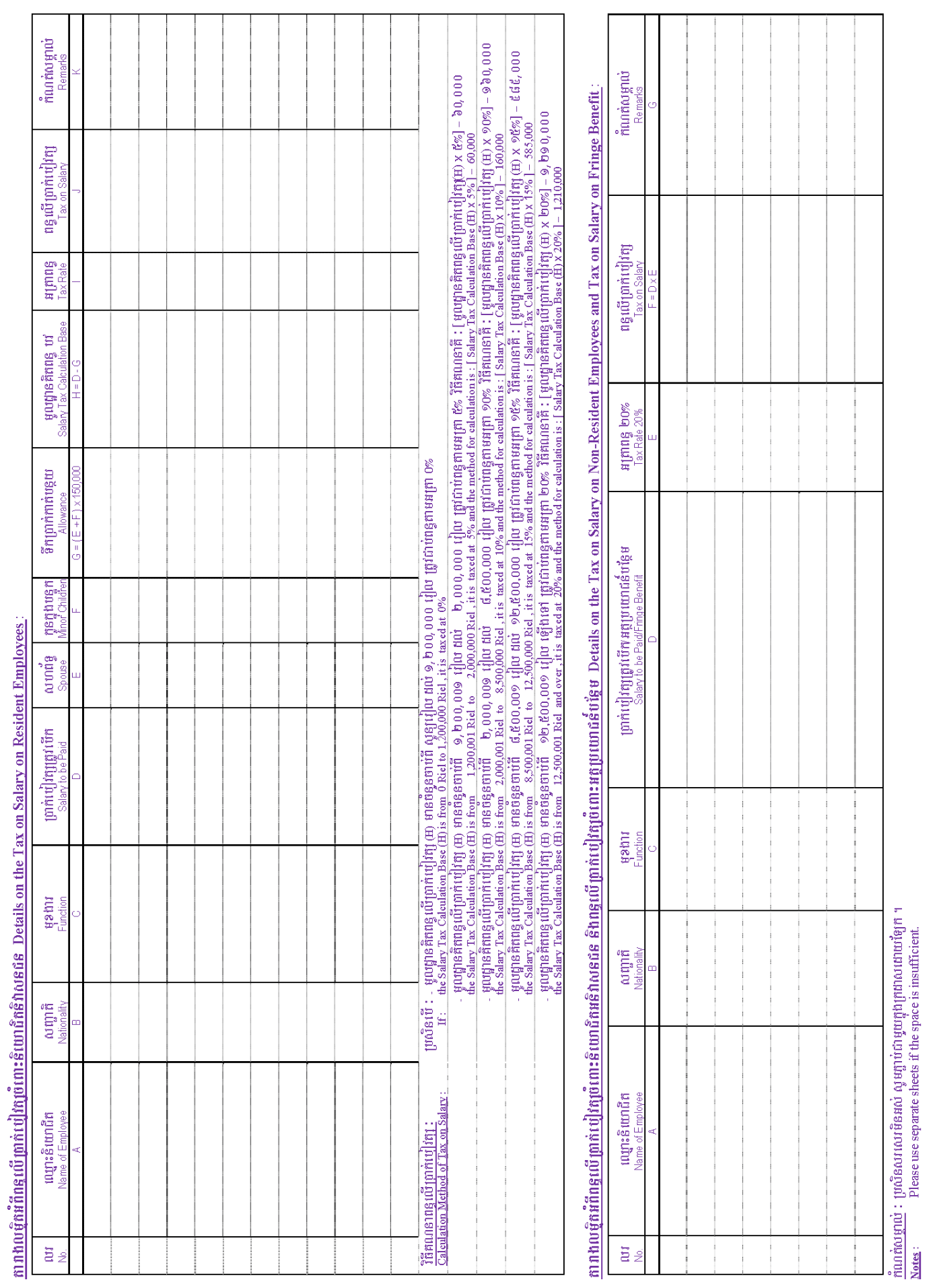

2.We will record salary for September 2018 the same as table below.

Information included Employee Names,Nationality,Functions, Salary , Spouse, Minor Children etc.

———

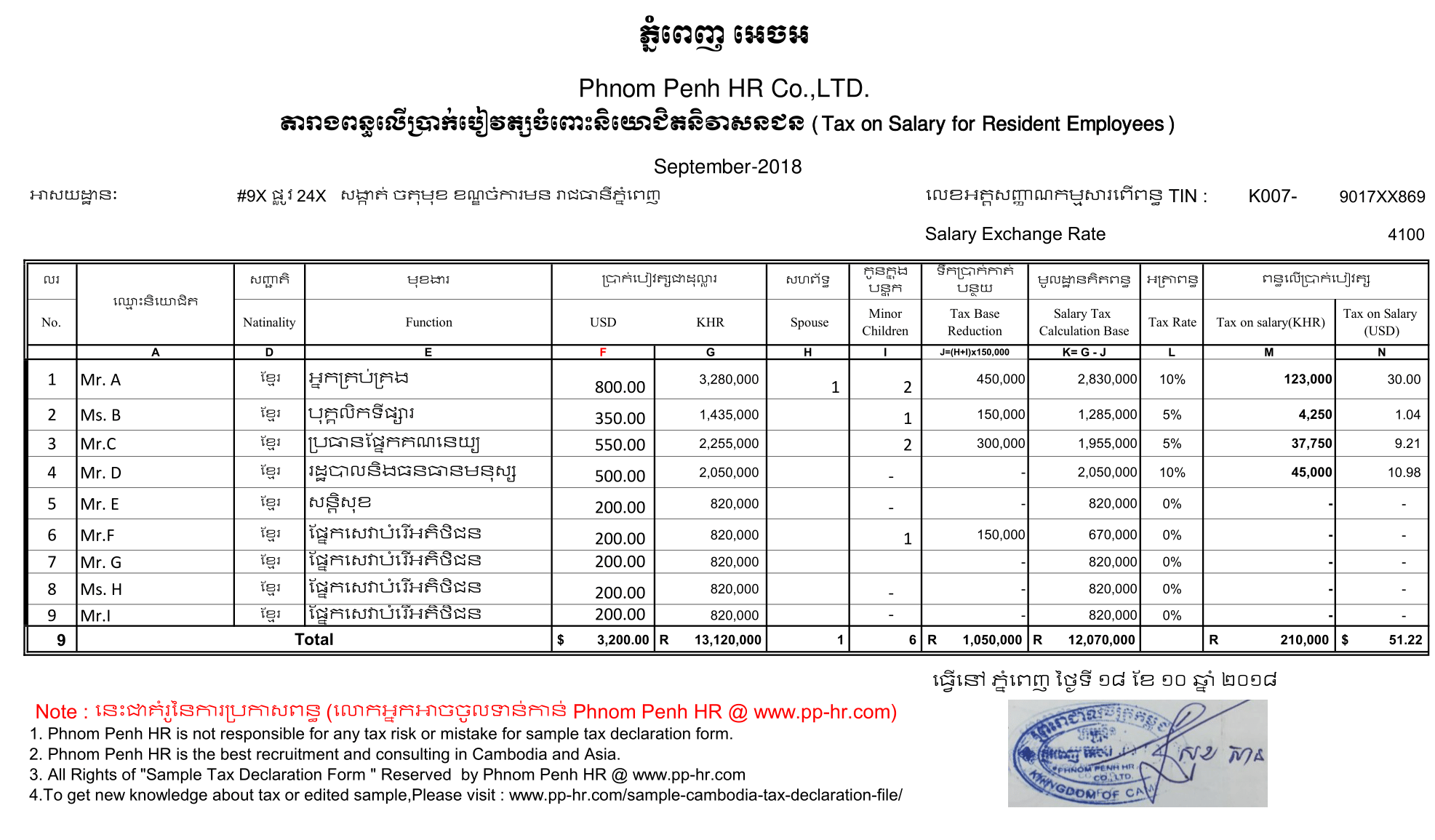

3.We will record purchase and expense for September 2018 the same as table below.

Information included Date, Invoice Number,Suppliers Name, VAT No. , Description, Quantity (Qty) purchased etc.

——

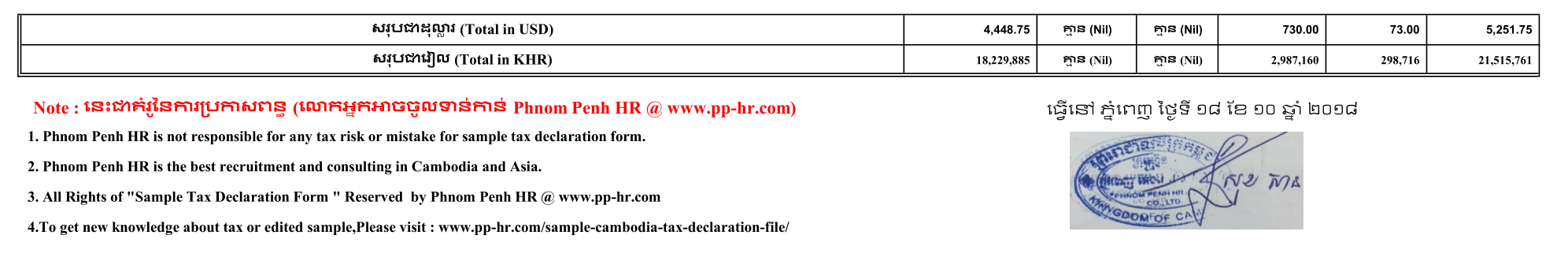

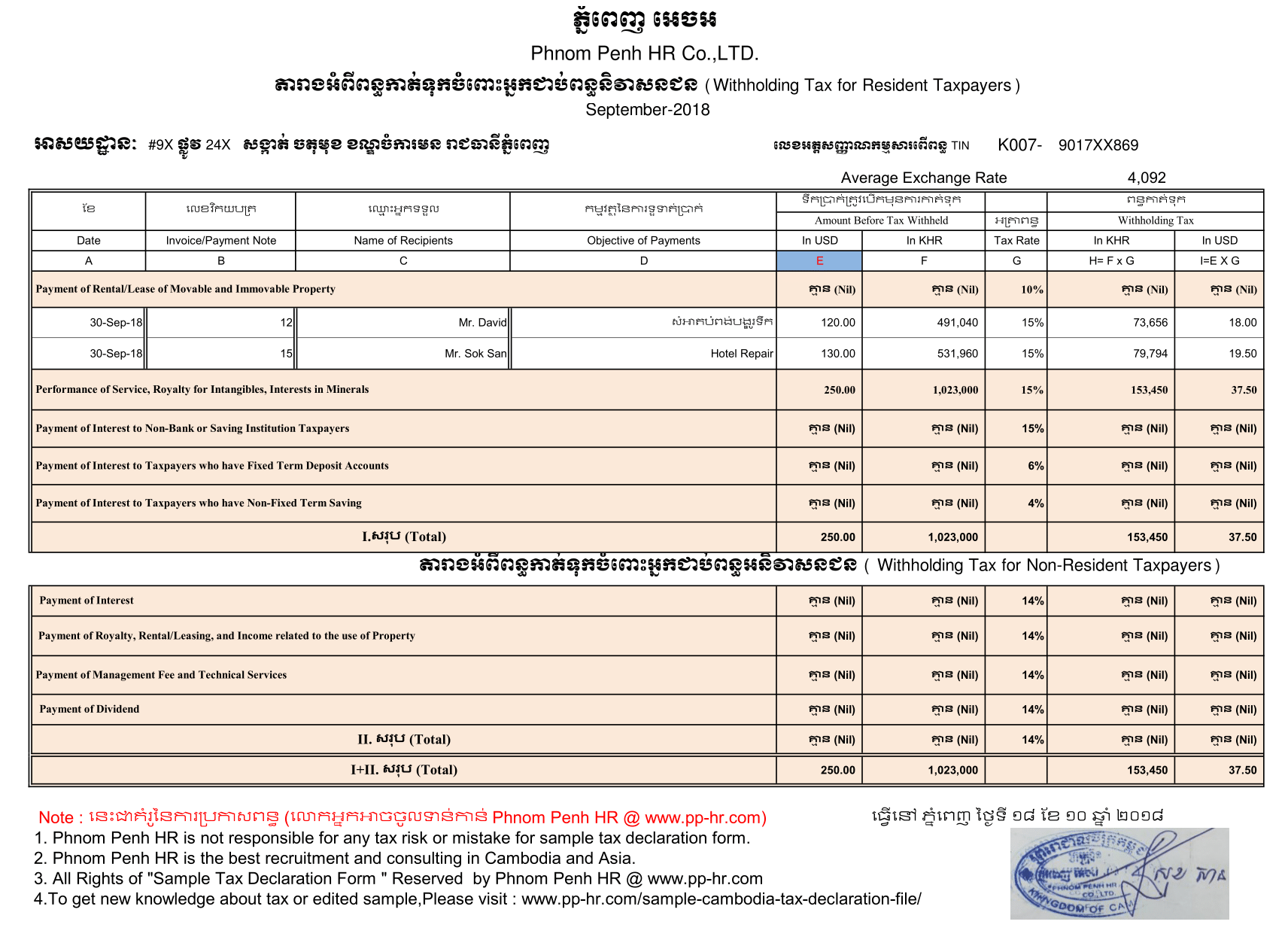

4.We will record withholding tax information for September 2018 the same as table below.

Information included Date, Invoice Number, Name of Recipient, Objective of Payment etc, and withholding tax information taken from purchase record ( above)

——

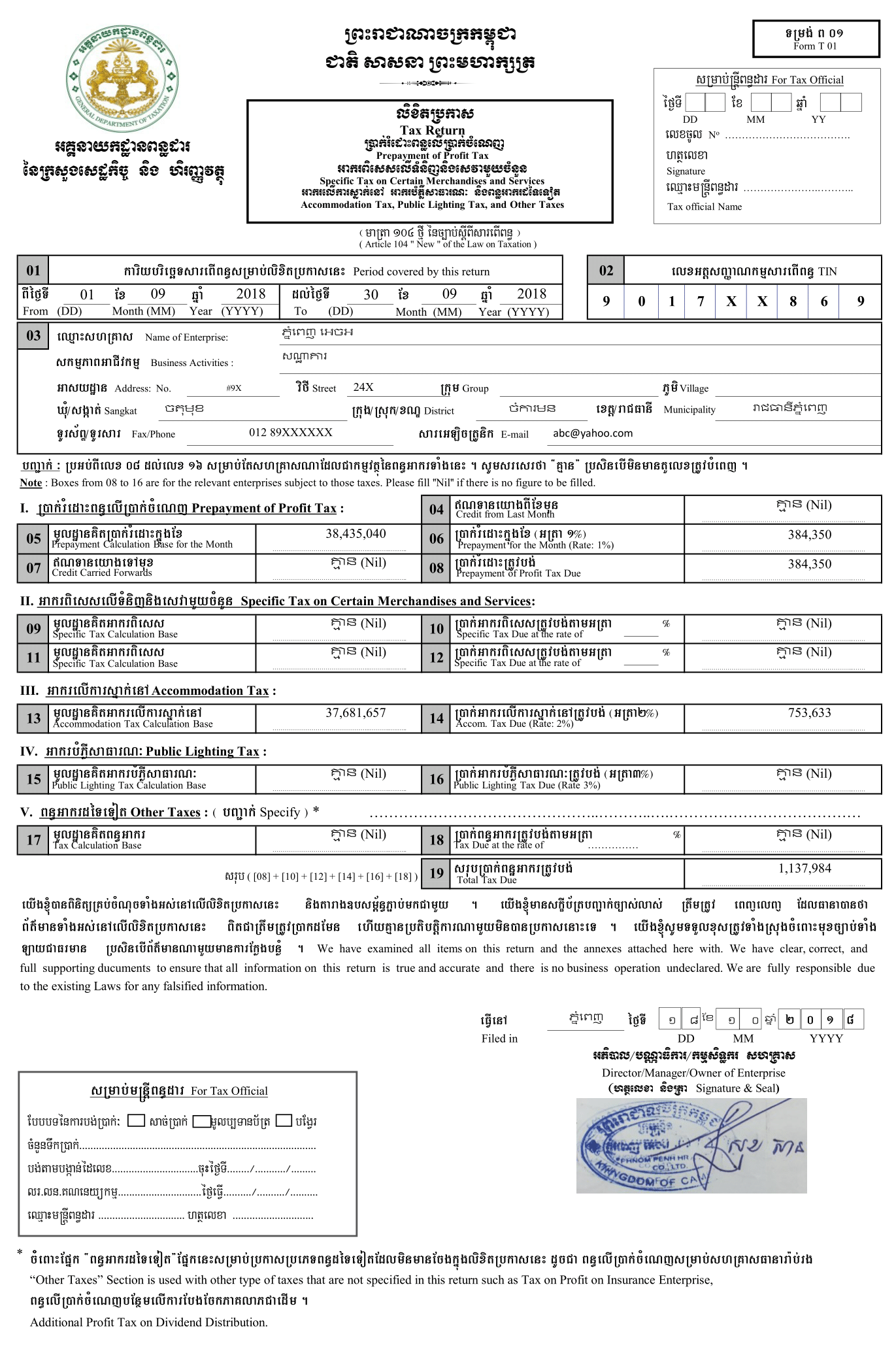

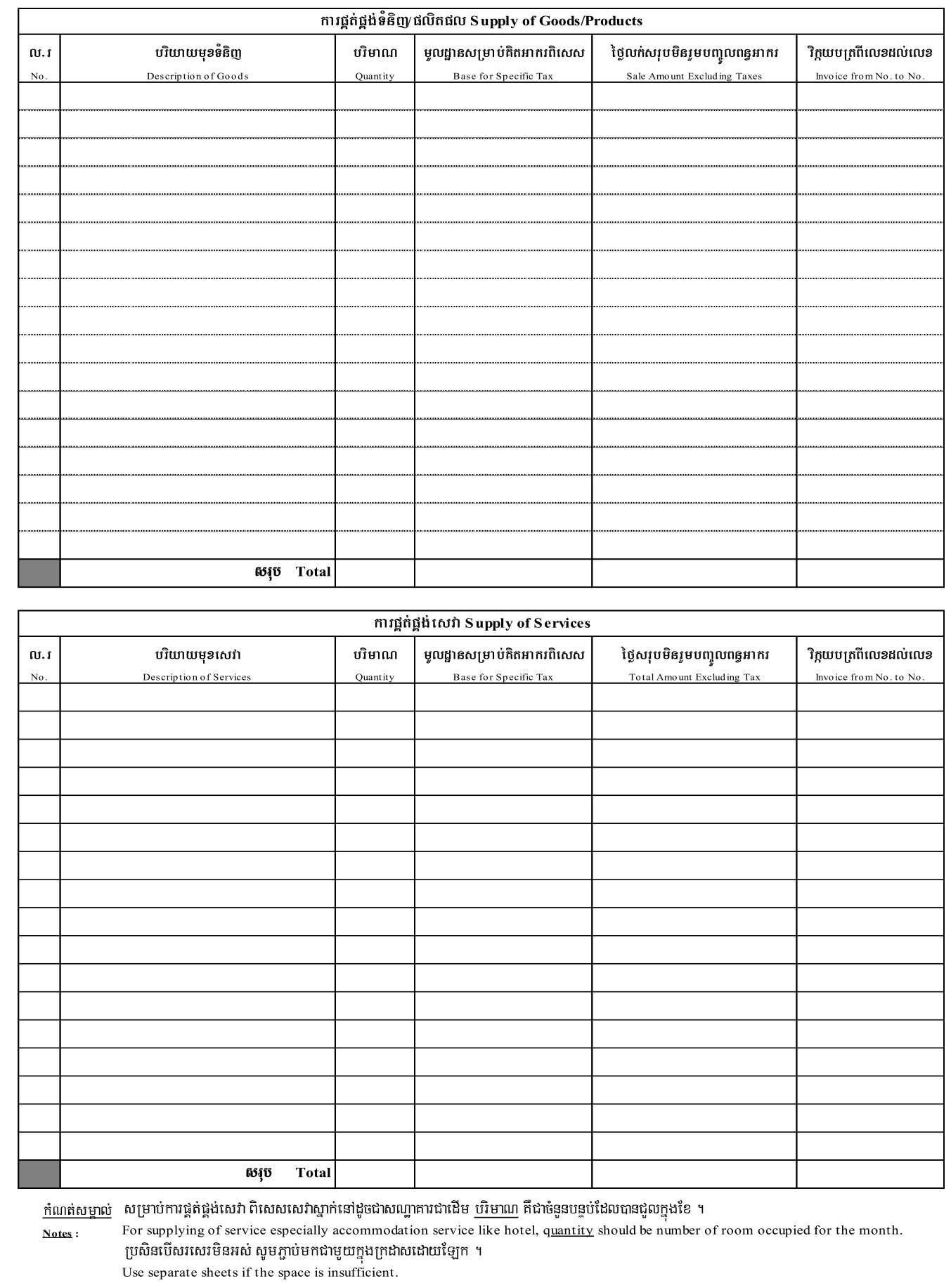

5.We will fill sale information above for September 2018 the same as tax Form T 01 below.

Taxes for Form T 01 included Prepayment of Profit Tax, Specific tax on certain merchandises and services, accommodation tax, pubic lighting tax etc.

——

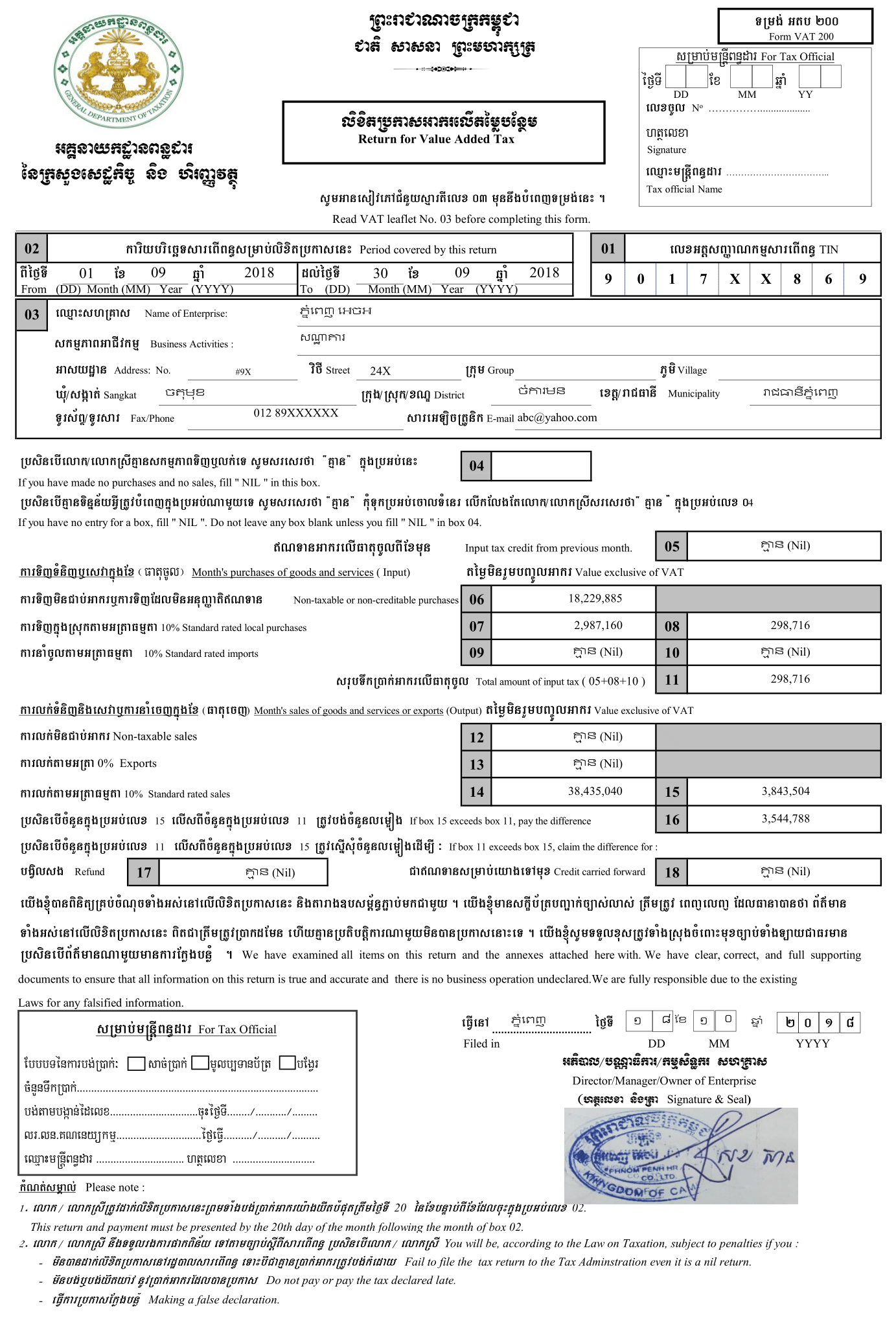

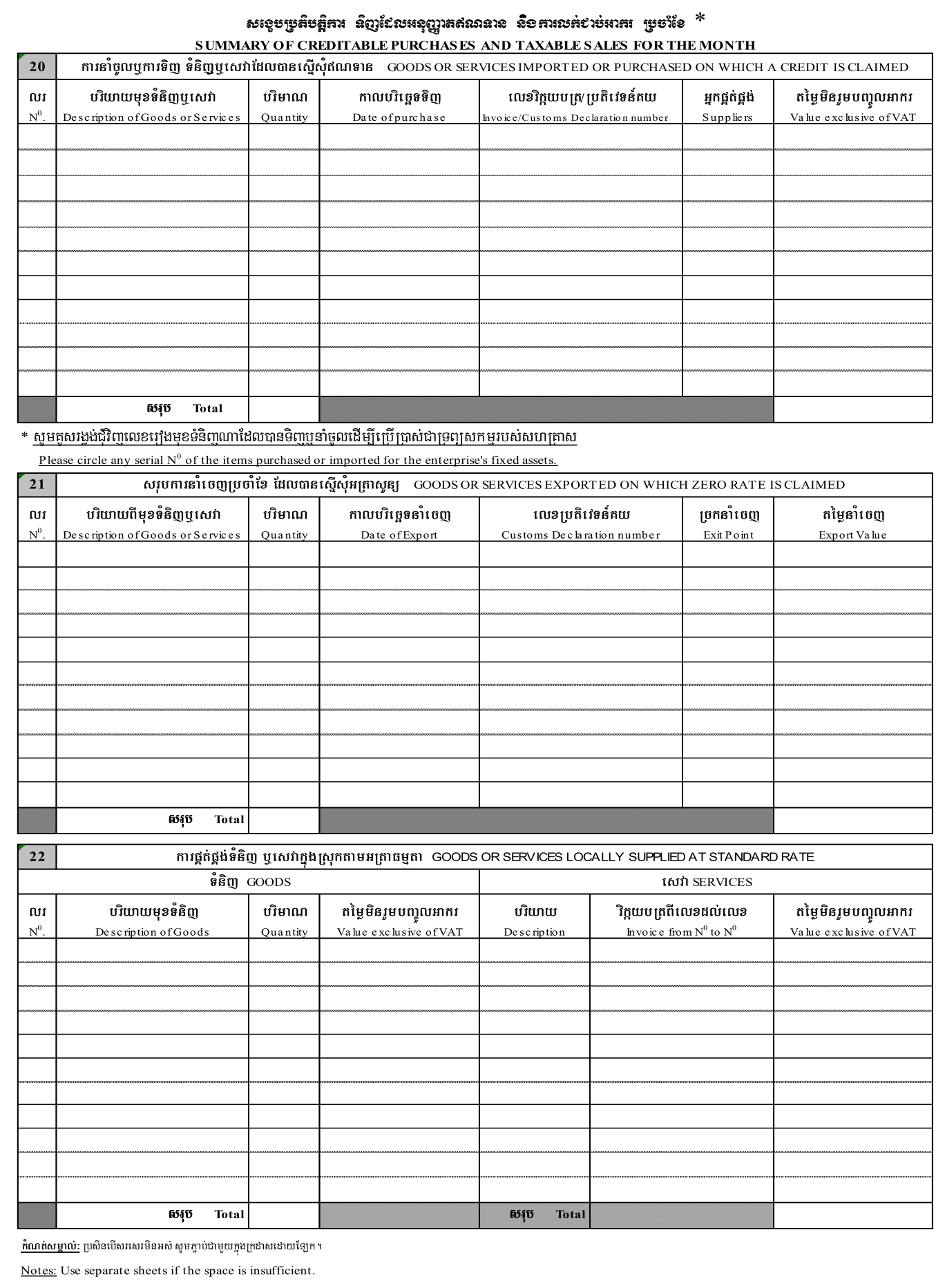

6.We will fill sale and purchase information above for September 2018 the same as tax Form VAT 200 below.

Information for Form VAT 200 included Input Tax Credit from Previous Month ( beginning VAT credit), VAT input during month , VAT output during month etc.

——

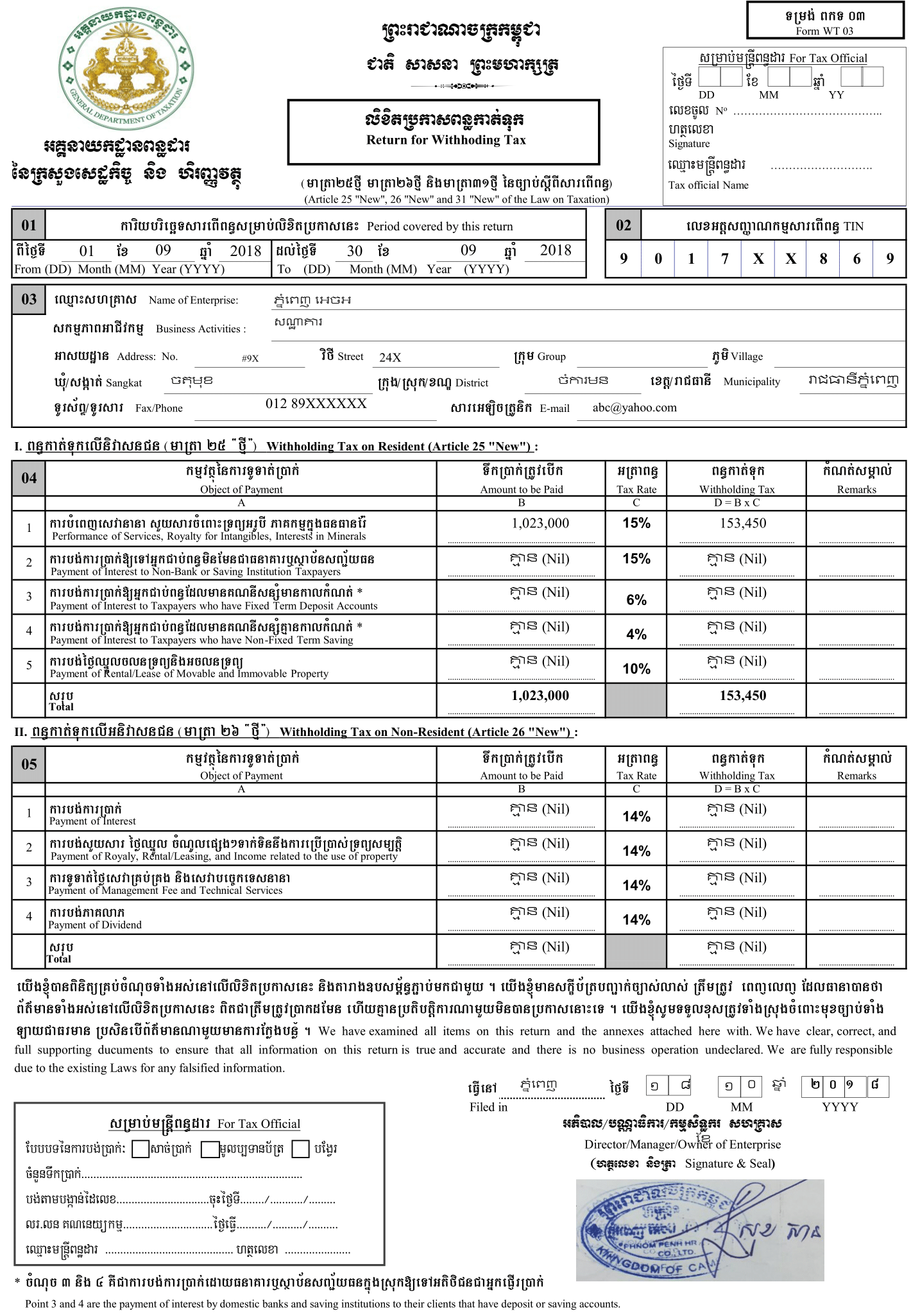

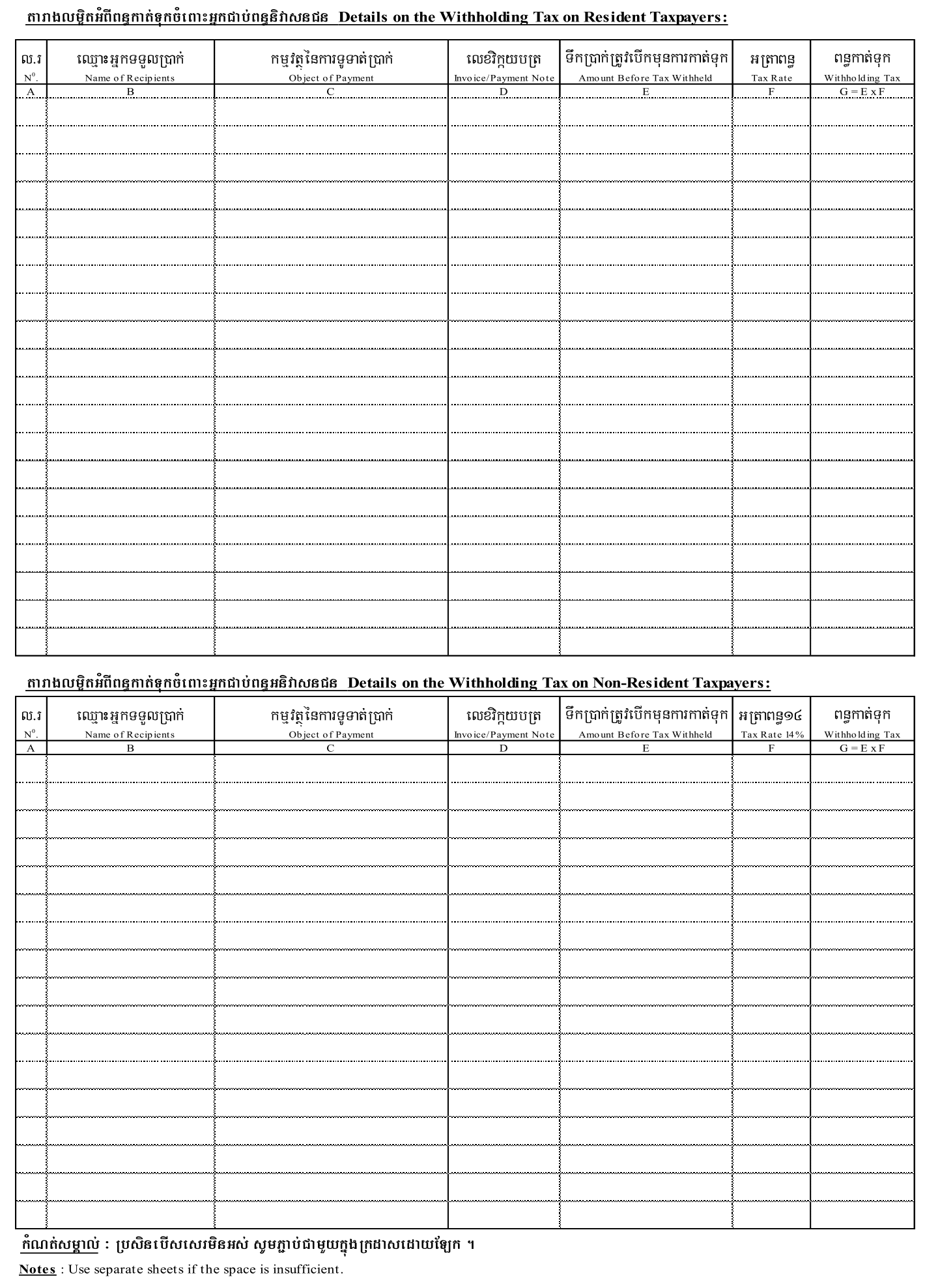

7.We will fill expense information relevant to withholding above for September 2018 the same as tax Form WH 03 below.

Taxes for WH 03 included withholding tax on resident ,withholding tax on non-resident etc.

——

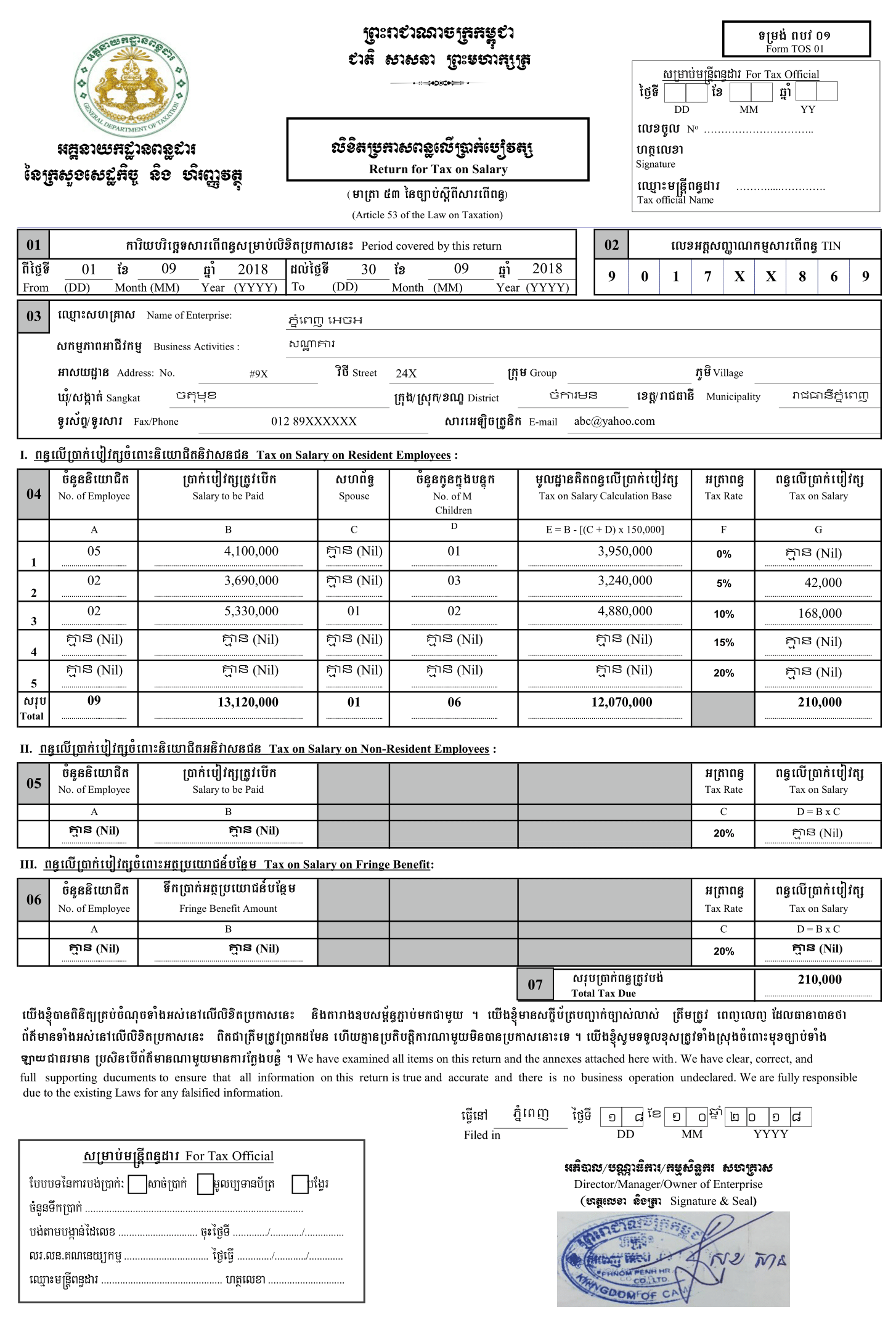

8.We will fill salary information for September 2018 the same as tax Form TOS 01 below.

Taxes for Form TOS 01 included tax on salary on resident Employees , Tax on salary on non-resident Employees etc.

——

Below are explained about figures filled in tax forms above.

Assume Phnom Penh HR is famous hotel in Cambodia company. The following transactions for monthly tax declaration are as follows.

Sale Information:

Sale information is given in sale record at point 1 (below ), please note in practice, generally we record total sale per day.

Salary Information :

Information about employee salary given at point 2 (below), please note that company has 9 employees.

Purchase and Expense information:

About formation of purchase and expense during September are given at point 3 ( below) .

Monthly Exchange Rate Information:

-Salary exchange rate for February: $1=4100 KHR

-Average Exchange rate for February: $1 =4092 KHR

VAT Information:

No VAT credit ( beginning balance) brought from previous months.

Key Point: word ” Hotel” for Cambodia Tax included the following business activities.

– Hotel

– Hotel Apartment

– Suite Hotel

– Resort Hotel

– Motel

-Lodge

– Bungalow

– Guest House

– Tourist Camping

Note:

-All of Sample Tax Declaration forms above are rights reserved by Phnom Penh HR, the best recruitment & consulting firm in Cambodia and Asia.

-For Any questions and suggestion, please contact us via info@pp-hr.com

-In practice, Tax Declaration forms may be different styles.