PROFITABILITY INDEX (PI) FOR INDEPENDENT PROJECT

Company may have some projects to make decision invest or not. The independent project is one whose acceptance or rejection is independent of the acceptance or rejection of the other projects.

PI = PV/I

PV: sum of present value of cash flows subsequent to initial cash flow

I: initial cash flow

Accept/Reject Decision:

- if Independent project PI > 1=> accept the project

- if Independent project PI<1=> reject the project

Example:

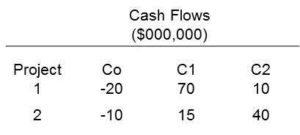

ABC Corporation applies a 12 percent discount rate to two investment opportunities, and we assume both projects are independent.

Required:

- Determine PI for both projects.

- Make decision for these projects.

Solution:

- NPVs

- Project 1

PV (project 1) = 70/(1+12%)^1 + 10/(1+12%)^2=$ 70,500,000

Initial investment = 20,000,000

PI(project 1) =70,500,000/20,000,000=3.53

- Project 2

PV (project 2) = 15/(1+12%)^1 + 40/(1+12%)^2 =$ 45,300,000

Initial investment =10,000,000

PI ( project 2) = 45,300,000/10,000,000=4.53

- Decision

PI (project 1)=3.53>1

PI (project 2)=4.53>1

Because both projects are independent, so we should choose both projects.

Source:

- Phnom Penh HR

- Mcgraw-Hill – Fundamentals Of Corporate Finance