PROFITABILITY INDEX (PI)

Profitability index (PI) is the present value of an investment’s future cash flows divided by its initial cost. Also, it is benefit-cost ratio.

PI = PV/I

PV: sum of present value of cash flows subsequent to initial cash flow

I: initial cash flow

Accept/Reject Decision:

- if PI>1=> accept the project

- if PI<1=> reject the project

Advantages of Profitability Index (PI) :

- Closely related to NPV, generally leading to identical decisions.

- Easy to understand and communicate.

- May be useful when available investment funds are limited.

Disadvantages of Profitability Index (PI):

It may lead to incorrect decisions in comparisons of mutually exclusive investments.

Example:

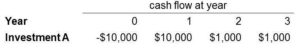

Investment A has the following cash flows:

If discount rate is 10 percent, is it good investment?

Solution:

PV=10,000/(1+0.1)1+1,000/(1+0.1)2+1,000/(1+0.1)3=10,669

Initial investment =10,000

PI=10,669/10,000=1.07 > 1. It means that $1 investment will return PV of $1.07, so this project should be taken.

Source:

- Phnom Penh HR

- Mcgraw-Hill – Fundamentals Of Corporate Finance