TOP ONE TRADING COMPANY is a company incorporated in Cambodia since 2014. TOP ONE TRADING COMPANY is merchandising company, and company has two major products.

Under the tax regulations, TOP ONE TRADING COMPANY is required to calculate and pay annual Tax on Profit. The following financial statements in relation to the tax year ended 31 December 2016.

|

TOP ONE TRADING COMPANY |

||

|

Income Statement |

||

|

For 2016 |

||

| Note | ||

| Sale: | ||

| Sale from Computers | 220,000 | |

| Sale from Phones | 110,000 | |

| Total Sale …………………………………….. | 330,000 | |

| Cost of Goods Sold: | ||

| Computers-COGS ……………………………………. | 100,000 | |

| Phones-COGS …………………………………. | 90,000 | |

| Total COGS …………………………………….. | 190,000 | |

| Gross Profit ……………………………………. | 140,000 | |

| Total Expense: | ||

| Advertising …………………………………………….. | 4,000 | |

| Salary …………………………………………………….. | 60,000 | |

| Office supply ………………………………………….. | 700 | |

| Electricity ………………………………………….. | 2,000 | |

| Water supply………………………………………….. | 400 | |

| Rental …………………………………………………… | 12,000 | |

| Telephone and Internet………………………… | 800 | |

| Depreciation………………………………………….. | 10,600 | 1 |

| Entertainment …………………………………… | 1,700 | |

| Other expense…………………………………… | 10,400 | 2 |

| Total Expense………………………………………….. | 102,600 | |

| Profit/(loss) before tax ………………………………… | 37,400 | |

|

TOP ONE TRADING COMPANY |

||||||

|

BALANCE SHEET |

||||||

|

AS OF 31 DECEMBER 2016 |

||||||

| Note | ||||||

| Current Assets | ||||||

| CASH | ||||||

| Cash on Hand | 10,000 | |||||

| Cash at Bank | 50,000 | |||||

| 60,000 | ||||||

| AR | 40,000 | |||||

| INVENTORY | 70,000 | 3 | ||||

| OTHER ASSET | ||||||

| Advance | for project….. | 7,130 | ||||

| Prepayment | of Profit Tax. | 3,000 | 4 | |||

| 10,130 | ||||||

| Total Current Assets | 180,130 | |||||

| Fixed Assets | ||||||

| Computer | Equipment.. | 1,200 | ||||

| Office | Equipment.. | 1,600 | ||||

| Office | Furniture… | 2,400 | ||||

| Vehicle | ……………… | 12,000 | ||||

| Other Fixed | Assets……… | 4,000 | ||||

| Total Net Fixed Asset | ……………….. | …………. | 21,200 | |||

| Total Assets | ………………. | …………. | ………. | 201,330 | ||

| Current Liability (CL) | ||||||

| AP…… | …………….. | ………… | 50,000 | |||

| Other CL | ||||||

| Other | Payable….. | 1,000 | 5 | |||

| Tax | liability….. | 930 | ||||

| 1,930 | ||||||

| Total Current Liability | ………………. | ………….. | 51,930 | |||

| EQUITY | ||||||

| Owner’s | Capital….. | 100,000 | ||||

| Retained | Earning… | 12,000 | ||||

| Current Profit | before tax… | 37,400 | ||||

| TOTAL EQUITY…… | …………… | ……….. | 149,400 | |||

| TOTAL LIABILITY & | EQUITY… | …….. | ……….. | 201,330 | ||

The following notes are as follows:

Note 1

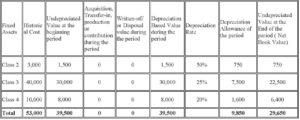

Depreciation expense is based on accounting policy.

Note 2

- Company made provision for warranty expense on sold products is $500.

- Repair and maintenance of company’s car is $500.

- Patent expense is $300.

- TOP ONE TRADING COMPANY donated $3,000 and $1,200 to theCambodian Red Cross (CRC) and homeless people respectively.

Note 3

Company has beginning inventory of $50,000.

Note 4

Prepayment of Profit Tax is excluded revenue earned on December 2016 for tax calculation base.

Note 5

Company made provision for warranty on sold products is $500.

Other information as follows:

Depreciation of Tangible Fixed Assets Class 2 – 4 (Declining Balance Method) for 2015

Tax profits are $10,000 and $7,000 for year 2014 and 2015 respectively.

Required:

Ignore other information, solve the following issues:

Declare tax on profit and complete financial figures (2016) if any accordance with tax form requirement from page 3/16 to 16/16. You may require to adjusted income statement and balance sheet.

Download the following 5 Answer Here :

3.IS

4.BS