Multiple Internal Return of Return (IRR) for Mixture Project

Internal rate of return (IRR) is the discount rate that makes Net Present Value (NPV) of investment zero.

NPV = initial cash flow – sum of present value of each cash outflow + sum of present value of each cash inflow

Mixture project has multiple IRRs. In theory, a cash flow stream with K changes in sign after initial cash flow can have up to positive K sensible interest rates of return.

Project Decision:

It is invalid IRRs for mixture project decision, but to avoid the multiple-IRR problem, we can solve this case with following methods:

- Use Modified IRR (MIRR): combining cash flows until only one change in sign remains.

- Build Net Present Value (NPV) graph/profile

Example:

Company has the following Project A for investment opportunity.

| Project A | |||

| Dates: | 0 | 1 | 2 |

| Cash Flow | -$100 | $230 | -$132 |

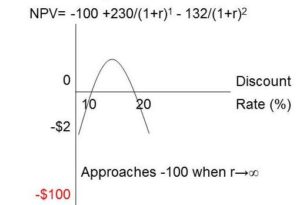

NPV= -100 + 230/(1+r)^1 – 132/(1+r)^2

IRR1= 10%

IRR 2 =20%

Required:

- Assume that required rate of return is 14%, using Modified Internal Rate of Return (MIRR) for project decision.

- Build graph or profile, and commend this project.

Solution:

- MIRR

- For project A, Cash outflow at date 2 is -$132.

- With a discount rate of 14 percent, so PV=-$132/(1+14%)= -$115.79

- The adjusted cash flow at date 1 is $114.21(130-115.79). Thus, the MIRR approach produces the following two cash flows for the project: (-$100, $114.21)

- Adjusted NPV=-100+114.21/(1+IRR)=> IRR=14.21%

- Because of IRR=14.21%> 14%, so the project should be accepted if required rate of 14%.

- Graph or Profile

- Project A has two changes of sign in its cash flows. It has an outflow at date 0 ,an inflow at date 1, and an outflow at date 2.

- This project has given two IRRs: 10% and 20%, and its NPV is positively when discount rate between 10% and 20%.

- According to graph, if required rates are between 10% and 20% (rates make positive NPVs), so the Project A will be accepted otherwise rejected.

Source:

- Phnom Penh HR

- Mcgraw-Hill – Fundamentals Of Corporate Finance