Internal Rate of Return (IRR) for Investing Project

Internal rate of return (IRR) is the discount rate that makes Net Present Value (NPV) of investment zero.

NPV =sum of present value of each cash inflow – initial investment when NPV=0, so sum of present value of each cash inflow =initial investment

Investing project has only one IRR.

To determine IRR, we can use the following way:

IRR= r1 + [(r2-r1)/(NPVr1-NPVr2)] x NPVr1, so normally discount rate 2( r2) > discount rate 1 (r1)

Project Decision:

– if IRR>cost of capital => accept the project

– if IRR<cost of capital => Reject the project

Advantages for Internal Rate of Return (IRR):

- Closely related to NPV, often leading to identical decisions.

- Easy to understand and communicate.

Disadvantages for Internal Rate of Return (IRR):

- May result in multiple answers or not deal with unconventional cash flows.

- May lead to incorrect decisions in comparisons of mutually exclusive investment

Example:

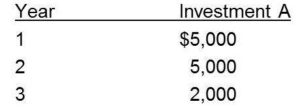

Capital investment of $10,000 for three years has cash flows below:

Required:

- Calculate internal rate of return (IRR)

- Make decision, and required rate of return of 15%

Solution:

- Internal Rate of Return (IRR)

NPV=5,000/(1+r)^1 +5,000/(1+r)^2+2,000/(1+r)^3 – 10,000

NPV at 10% = $177

NPV at 12% = ($126)

IRR=10%+[(12%-10%)/(177+126)] x 177 = 11.17%

- Decision

IRR=11.17%

Required rate of return = 15%

15%>11.17%, so the project should be rejected.

Source:

- Phnom Penh HR

- Mcgraw-Hill – Fundamentals Of Corporate Finance