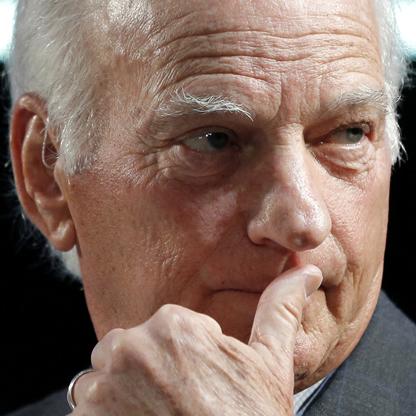

George Roberts

REAL TIME NET WORTH — as of 4/21/17

$4.9 B

George Roberts is cofounder and co-CEO of private equity giant KKR & Co. and a pioneer in the leveraged buyout business. Along with his cousin and former Bear Sterns colleague Henry Kravis and their mentor Jerome Kohlberg, the three led KKR through a series of debt-financed hostile takeovers starting in the 1970s, the most notable of which was the firm’s highly publicized 1988 buyout of RJR Nabisco, chronicled in the book “Barbarians At The Gate. ” Kohlberg left the firm a year before the completion of the deal– reportedly over concerns about the firm’s preference for large-scale takeovers. A trailblazer away from the Street as well, Roberts has also helped create the concept of venture philanthropy. His nonprofit, REDF, invests in companies that train and provide jobs for the disadvantaged; thus far, he’s funded over 50 social enterprises that have altogether employed more than 11,000 people and generated more than $163 million in revenue.

George Roberts Net Worth: George Roberts is an American financier who has a net worth of $5 billion. Co-chairman and co-CEO of Kohlberg Kravis Roberts, George Roberts enjoyed another strong year in 2013. Today, KKR is said to have $95 billion in assets under management and estimated $691 million in net profit for 2013. The company’s profits increased 23% compared to last year. Its share price grew more than 30%. Some of KKR’s notable investments include domain name vendor GoDaddy Group and Toys R Us. Prior to becoming leveraged buyout legend, George Roberts studied at the Claremont McKenna College, University of California, Hastings College of the Law and Culver Military Academy. Upon graduation, he joined Bear Stearns and few years later he became a partner in the company. He was just 29 years old at the time. In 1976, he set up KKR along with his cousin Henry Kravis and Bear Stearns mentor Jerome Kohlberg. The company was among the pioneers that used leverage in huge acquisitions. KKR became internationally famous after arranging the $25 billion buyout of RJR Nabisco, a deal that was detailed in the bestselling book “Barbarians at the Gate”. Some of KKR’s other successful deals include the acquisition of Orkin Exterminating Company, Incom, Stern Metals, Boren Clay, Cobblers Industries, Eagle Motors, Barrows and Thompson Wire.

Source:

1. forbes