Future Value of Single Cash Flow for Multiple-Period Investment with Compound Interest

Future Value with a Single Cash Flow:

Time value of money for a single cash flow is a cash inflow or outflow that investors or lenders received from or paid to once respectively for specific periods.

Future value (FV) refers to the amount of money an investment or present value (PV) will grow for specific periods of time at specific interest rate.

Future Value = Present Value + all earned interests

Multiple-Period Investment:

Multiple-period investment may be investment for more than one year. Term multiple-period can refer to more than one day or one month investment, so it isn’t always more than one year investment.

If period investments are based on one day, one month or one year etc., so discount rates are based on one day, one month or one year respectively.

Definition of Compound Interest:

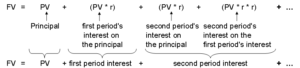

Compound Interest means Interest earned on both the principal and the interest reinvested from previous periods.

Formula of compound interest future value for Multiple-Period Investment:

So FV=PVx(1+r)t

Which

PV: Present Value or principal is worth today

FV: Future value is worth in the future

r : Interest rate, rate of return, or discount rate per period , but not always one year.

t : time is referred to number of periods of investment

Question

Assume you deposit $20,000 at XYZ Bank today in an account that pays 6 percent interest.

How much will you have in five years?

Solution

FV=PVx(1+r)t=20,000x(1+6%)5=20,000*1.3382=$26,764

After five years, we will get amount of $26,764 from XYZ Bank.