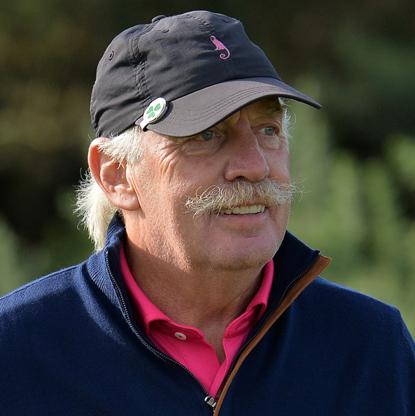

Dermot Desmond is an Irish businessman and financier. He is estimated to be worth €1.35 billion and is ranked by the Sunday Independent as the seventh-richest person in Ireland.

Early life and education

Desmond was born in Macroom, County Cork in 1950 and grew up in Marino, Dublin. He was educated at Scoil Mhuire, Marino and Good Counsel College in New Ross. He left school in 1968 to work at Citibank in Dublin.

Business career

In 1968, Desmond’s business career began with Citibank in Dublin, followed by Pricewaterhouse Coopers in Kabul, Afghanistan.

In 1981, he founded National City Brokers in Dublin. The company competed with already established stockbroking names in Dublin such as Davy’s and Goodbodys. Desmond sold the company to Ulster Bank in 1994, which at the time was part of the National Westminster Group, for a reported £39 million. Subsequently as a result of Natwest’s takeoever in 2003 by RBS, NCB was bought out by its management with the support of former billionaire businessman Sean Quinn who is believed to now control 25% of the company.

He was appointed chairman of the board of Aer Rianta in 1990 under the Charles Haughey government, but resigned in October 1991 amid the scandal over the purchase of the Johnston Mooney & O’Brien site by Telecom Éireann.

In 1995, he founded International Investment & Underwriting (IIU), a private equity firm and his primary investment vehicle. It is located in Ireland’s International Financial Services Centre (IFSC) and is regulated by the Financial Services Regulatory Authority. Companies that are controlled through IIU include BETDAQ (an international betting exchange) and DAON (a biometric enabling technology company). IIU Asset Strategies Limited is the hedge fund arm of the company, offering convertible bonds and equity funds.

In 1996 Desmond backed a consortium headed by Fran Rooney to purchase Baltimore Technologies for £300,000. The company quickly purchased an e-commerce license from the EU and it experienced rapid growth over the following years. It was briefly a member of the FTSE 100 and had a market capitalization of £4.5 Billion. The company though fell victim to the dotcom bust and all but collapsed.

In 1997, together with business partners John Magnier and J.P. McManus, Desmond purchased the luxurious five-star Barbados resort Sandy Lane Hotel. The Hotel underwent a US$450 million renovation and was re-opened in 2001.

Desmond purchased London City Airport from Mowlem for £23.5m in 1995. The investment was considered a large risk as London’s Docklands was in recession and the neighbouring Canary Wharf development was in receivership. The airport has since become one of the more profitable in the United Kingdom. Desmond sold London City Airport in October 2006 for a reported £750 million to a consortium consisting of insurer AIG, GE Capital and Credit Suisse.

BETDAQ is the trading name of Global Betting Exchange, a betting exchange operator based in Ireland. It is the second largest betting exchange operator in the market, with Betfair being the largest. The company was founded in 2000 by Dermot Desmond and started trading in September 2001. Its headquarters are also located in the International Financial Services Centre in Dublin. Desmond sold BETDAQ to Ladbrokes for €30 million in 2013 and is a shareholder at the bookmaker as a result of the deal.

Desmond was a major shareholder in Irish food company Greencore for a number of years. He sold his shares in 2006.

In 2005 Desmond opened the Sporting Emporium, a Dublin-based private members gaming club. It was reported Desmond had invested €5.5 million of his own money in the venture. After being open for only seven months it faced closure.

Desmond purchased 33.1% of Latvian Rietumu Banka in 2005 for a reported €66 million. He invested in the bank as a result of being very impressed with its management team and capital structure. The investment in Rietumu initially looked a successful one with Desmond’s holding at one stage being valued at €200 million. However, the subsequent economic downturn has reduced the value of Desmond’s holding in the bank significantly.

In August 2008, Desmond was offered the position of chairman of the Irish airline Aer Lingus. Desmond turned down the offer citing prior commitments as a factor which would not allow him the sufficient time necessary to do the job. Former GPA chief operating officer and current Babcock & Brown Air chief executive Colm Barrington was subsequently named chairman of Aer Lingus.

Desmond owns a stake in Toronto mining company Mountain Province Diamonds that is valued at £25 million. The company’s sole asset is the Canadian Gahcho Kue Diamond Mine Project.

Summary

| Dermot Desmond | |

|---|---|

| Born | 14 August 1950 Macroom, County Cork |

| Residence | UK, Gibraltar, Barbados |

| Occupation | Largest individual shareholder within Celtic Football Club |

| Net worth | |

| Spouse(s) | Pat Desmond |

| Children | 4 |

Source:wikipedia