Cost of Inventory-Products for manufacturing company

Cost of Inventory for manufacturing company

The examples of manufacturing company are as follows.

- Company manufactures and sells phones, computers, scanners, LDC

- Company manufactures and sells cars, motor

- Company manufactures and sells furniture

- Company manufactures and sells TV

Cost of finished goods = cost of material + conversion cost

Cost of material = purchase price-trade discount-sale return and allowance+ freight + insurance + import taxation + Specific tax (if any) + port fee + clearance cost + other relevant costs

Note:

- Settlement discount because of early payment is excluded cost of inventory, so it is other income.

- VAT input is excluded cost of inventory if it can be claimed from VAT output when we sell inventories.

Conversion Cost- it included directs costs and production overheads. Direct cost included direct labor while Production overheads included heating and light, salary of supervisors, depreciation of plant, etc.

Our note:

- Cost of material refer to direct materials for this case

- Conversion costs are cost converting from direct materials to finished goods.

In practice, cost of finished goods= material + labour +overhead = specific cost + common cost

Costs are excluded from cost of inventories:

- Selling costs/marketing expense

- Storage costs ( or storage cost of finished goods)

- Abnormal waste of materials, labour or other costs

- Administrative overheads.

Example 1

XYZ Company manufactures and sells Table A. The costs of manufacturing table are as follows.

Wood………………………………..$20

Other materials…………………..$2

Direct labor………………………..$10

Other Production overhead…..$5

Required:

Calculate cost of Table

Solution

Cost of finished goods = cost of material + conversion cost

Cost of finished goods = 20 + (2+10+5)=$37

Cost of Table A is $37.

Example 2

Your company manufactured three products A, B and C.

| Product | Produced Units |

| A | 10,000 |

| B | 5,000 |

| C | 2,000 |

There are specific costs and common costs (absorption cost) for each products as follows:

The following costs are directly allocated ( specific costs) to each product.

| Cost | Product A | Product B | Product C |

| Material | 20,000 | 7,000 | 8,000 |

| Labour | 10,000 | 12,000 | 9,000 |

| Overhead | 4,000 | 2,000 | 2,000 |

| Total | $34,000 | $21,000 | $19,000 |

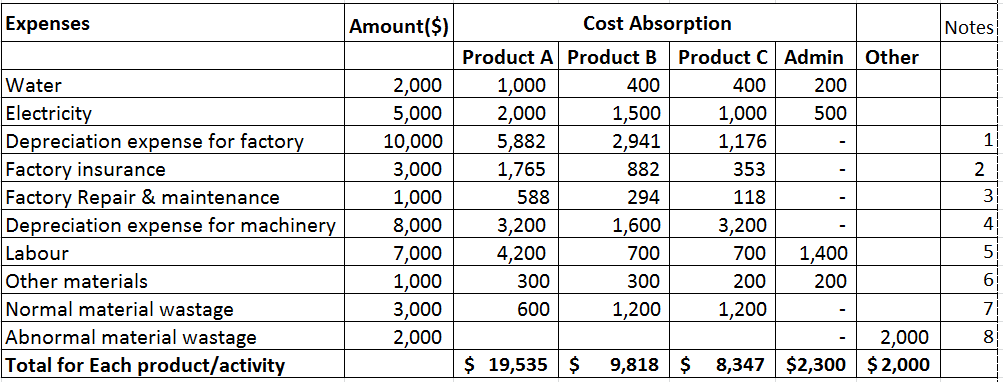

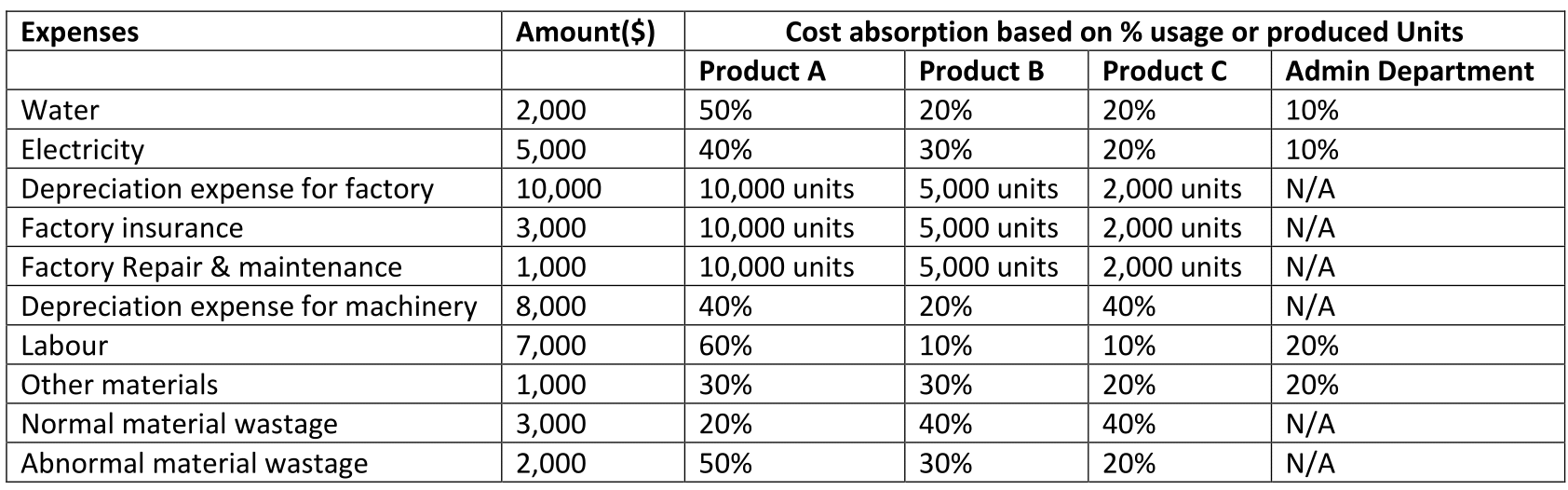

Below are the common expenses and costs , and percentages/absorption used for three products and admin department.

————–

Required:

- Calculate total costs for Product A, B and C

- Cost per unit for Product A, B and C

- Admin Costs

- Other Expense

Solution

The following notes:

| 1/ 10,000/17,000 x $10,000=5,882$ |

| 2/ 10,000/17,000 x $3,000=1,765 $ |

| 3/ 10,000/17,000 x $1,000=588 $ |

| 4/ 8,000 x 40%= 3,200$ |

| 5/ 7,000 x 60%= 4,200 $ |

| 6/ 1,000 x 30% = 300$ |

| 7/ 3,000 x 20%= 600$ |

| 8/ abnormal cost is other expense |

1.Calculate total costs for Product A, B and C

Total costs = material + labour +overhead = specific costs + common costs

Total Cost for Product A = $34,000 + $19,535 =$ 53,535

Total Cost for Product B =$21,000 + $9,818 = $30,818

Total Cost for Product C =$19,000 + $8,347 = $27,347

2.Cost per unit for Product A, B and C

Cost per unit = Total Costs for Each Product /Produced Units for Each Product

Cost per unit for Product A =$ 53,535/10,000= $5.35

Cost per unit for Product B = $30,818/5,000= $6.16

Cost per unit for Product C =$27,347/ 2,000= $13.67

3.Admin Costs

Admin costs = $2,300

4.Other Expense

Other expense = $2,000