CAPITAL STRUCTURE AND FINANCE COSTS (F3):

LEARNING OBJECTIVES

I.THE CAPITAL STRUCTURE OF A LIMITED LIABILITY COMPANY

II.ORDINARY SHARE CAPITAL

III.RIGHTS ISSUES

IV.BONUS ISSUES

V. DIVIDENDS

VI. LOAN NOTES ( LOAN STOCK)

VII. PREFERENCE SHARES

VIII. OTHER RESERVES

IX. INCOME TAX

………………………………………………

I. THE CAPITAL STRUCTURE OF A LIMITED LIABILITY COMPANY

Finance is provided by the capital invested in the business. There are a number of ways that a business can attract financial capital but each has its own characteristics and consequences. In general all forms of finance can be loosely categorised into two distinct groups.

-Debt, which requires some form of mandatory transfer of economic benefit to the provider of the finance, or

-Equity, which gives the provider of the finance the rights to share in the residual assets of the business when it ceases to trade.

For this chapter, you need to be aware of three forms of financial capital and how to record them in the financial statements:

i.Ordinary (equity) share capital: this is equity as the directors are under no obligation to repay the investors ( shareholders) or to pay them a dividend. An ordinary shareholding is evidence of ownership of company and the shareholders receive the residual interest in the business once it ceases to trade in proportion to the size of their shareholdings. Ordinary shares are shown under equity on the statement of financial position.

Directors may choose to pay the shareholders an annual dividend These are recognised in the statement of changes in equity, not the statement of profit or loss. This is not a deduction from profit; it is a distribution of profit to the rightful owners of it.

ii. Loan notes: under the terms of loan note agreements directors are usually required to pay the loan holder an annual interest amount and are obliged to repay the full debt at a fixed point in time. This is therefore a form of debt and appears as a liability on the statement of financial position.

The interest payment is treated as a finance charge, which is shown as an expense in the statement of profit or loss. This is a deduction from profit.

iii. Preference shares: these can be either debt or equity, depending on their terms. If there is any obligation to repay the preference shareholder ( redeemable) then this is evidence of a debt. These are shown as liabilities on the statement of financial position and any dividends paid to these shareholders would be treated as finance charges.

Irredeemable preference shares are shares that do not have to be repaid. They are therefore treated as equity in the statement of financial position. It must be made clear that they are not the same as ordinary shares as they do not entitle the owner to a residual interest in the business. The companying dividends are, however, treated the same as ordinary dividends in the financial statements.

<figure class=”op-ad”>

<iframe width=”300″ height=”250″ style=”border:0; margin:0;” src=”https://www.facebook.com/adnw_request?placement=961968597274031_961968610607363&adtype=banner300x250″></iframe>

</figure>

II. ORDINARY SHARE CAPITAL

As stated above, ordinary share capital is treated as equity and the associated dividend payments are recorded in the statement of changes in equity.

Each share has a nominal or par value, often $1, 50c or 25c. It is often perceived as the share’s minimum value. This value remain fixed, whereas the market value of the share fluctuates over time. This value is often used as a means of calculating dividends to shareholders ( paid as a percentage of the nominal value).

Accounting for the issue of shares:

If a company were to issue shares at their nominal value the double entry to record this raising of finance would be:

Dr. Cash …………..issue price x no.of shares

Cr. Share capital…nominal value x no. of shares

In reality companies generally issue shares at a price above their nominal value. This referred to as issuing shares at a premium.

Dr. Cash………………..…issue price x no. of shares

Cr. Share capital………nominal value x no. of shares

Cr. Share premium ….difference between cash and share capital.

Test 1

Bourbon issued 200,000 25c shares at a price of $1.75 each.

Show journal entry and leger accounts.

III. RIGHTS ISSUES

A rights issue is the offer new shares to existing shareholders in proportion to their existing shareholding at a stated price ( normally below market values).

The advantages are:

-A rights issue is the cheapest way for a company to raise finance through the issuing for further shares.

-A rights issue to existing shareholders has a greater chance of success compared with a share issue to the public.

The disadvantages are:

-A rights issue is more expensive than issuing debt.

-It may not be successful in raising the finance required.

A rights issue is accounted for in the same way as a normal share issue and therefore has exactly the same impact on the statement of financial position as an issue at full price.

Test 2

Upon incorporation in 20×4, The Jammy Dodger, a limited liability company, issues 1,000 50c shares at nominal value. Needing further funds, in 20X5 it makes a rights issue of 1 for 5 at $0.75. this offer is fully taken up.

What accounting entries are required in 20×4 and 20×5 ? Illustrate the relevant section of the statement of financial position at year end 20×5.

IV. BONUS ISSUES

A bonus issue is the issue of new shares to existing shareholders in proportion to their existing shareholding. No cash is received from a bonus issue.

The advantages are:

-Issued share capital is divided into a larger number of shares, thus making the market value of each one less, and so more marketable.

-Issued share capital is brought more into line with assets employed in the company by reducing stated reserves and increasing share capital.

The disadvantages are:

The admin costs of making the bonus issue.

As no cash is received from a bonus issue, the issue must be funded from reserves. Any reserve can be used, though a non-distributable reserve such as the share premium account would be used in preference to reserves which can be distributed:

Dr. share premium……….nominal value

( or other reserve)

Cr. Share capital …………nominal value.

Test 3:

Ginger Knut, a limited liability company, has 20,000 50c shares in issue ( each issued for $1.25) and makes a 1 for 4 bonus issue, capitalising the share premium account.

What are the balances on the share capital and share premium accounts after this transaction.

Test 4:

Rich T is a limited liability company with 200,000 25c shares in issue. At 1 January the balance on the share premium account is $75,000. The following transactions occur in the year ended 31 December 20X6:

31 January there is fully taken-up 2 for 5 rights issue. The issue price is $1.80.

12 August there is a 1 for 10 bonus issue made using the share premium account.

What are the balance on the share capital and share premium accounts on 31 December 20X6?

V. DIVIDENDS

Dividends represent the distribution of profits to shareholders. They are usually expressed as an amount per share e.g. 10c per share or 10% of nominal value.

Dividends on preference shares are usually based on a pre-determined amount, such as 5% of the nominal value of the shareholding.

The double entry:

A company may pay a mid-year or interim dividend.

Dr. Retained Earnings *………………xxx

Cr. Bank………………………………………xxx

*RE ( dividend) : disclose in statement of changes in equity

At the end of the year companies may propose or declare a dividend ( final dividend) to the ordinary shareholders. Proposed dividends at the end of the year that have not been approved by shareholders cannot be recorded as liabilities at the year-end.

VI. LOAN NOTES ( LOAN STOCK)

The term ‘loan note’ imply refers to the document that is evidence of the debt, often a certificate that is issued to the lender.

Similar to shares, the loan note will have a set nominal value, e.g. $100. Individual or organizations can buy the loan notes at an agreed price ( this can be any value, it does not have to be the same as the nominal value). The life of the loan note will be fixed and the company issuing them will have to pay the loan note holder back at an agreed point in time.

The issuer will also have to pay interest to the loan note holder. The interest will be calculated based on the nominal value of the loan note ( for example, 5% of the nominal value per annum). The interest incurred is included in ‘finance costs’ in the statement of profit or loss.

Accounting Entries:

Finance is received

Dr. Cash

Cr. Non-current liability

Finance charge is recognised

Dr. Finance charges ( P/L)

Cr. Cash/current liabilities ( depending on whether the interest has been paid or not)

Test 5:

Custard Creameries is an incorporated business which needs to raise funds to purchase plant and machinery. On 1 March 20X5 it issues $150,000 10% loan notes, redeemable in 10 years’ time. Interest is payable half yearly at the end of August and February.

What accounting entries are required in the year ended 31 December 20X5 ? Show relevant extracts from the statement of financial position.

VII. PREFERENCE SHARES

If preference shares are redeemable they are treated the same as loan notes; i.e. they are recorded as a liability in the statement of financial position and dividend payments are treated the same as finance charges.

If the preference shares are irredeemable the shareholding and associated dividends are treated exactly the same as ordinary shareholdings, as explained above.

Test 6:

Cracker, a company, has share capital as follows:

Ordinary share capital ( 50c shares) $200,000

8% irredeemable preference share capital $50,000

The company pays an interim dividend (i.e. a dividend declared part way through the financial year) of 12.5c per share to its ordinary shareholders and pays the preference shareholders their dividend, although this is not mandatory. Before the year end the company proposes a final dividend of 36.5c per share to its ordinary shareholders.

Calculate the amounts shown in the statement of change in equity (SOCIE) and statement of financial position (SFP) in relation to dividends for the year.

VIII. OTHER RESERVES

These capital sources represent the profits made by the business and the inflation in value of tangible non-current assets recognised in a revaluation. They are referred to as reserves or other components of equity.

Other reserves as follows:

Revaluation reserve :

-Records the unrealised gains on revaluation of property, plant and equipment.

-Cannot be paid out as a dividend

Retained earnings:

-Records the total of the net profits and losses earned/incurred to date that have been retained within the business (i.e. they have not been paid out as dividends yet).

-Can be distributed as dividends

IX. INCOME TAX

Steps for recording income tax:

Step 1

Company estimates tax liability

Dr. income tax charges ( P&L)

Cr. Income tax liability ( SoFP-current liability)

Step 2

Actual tax liability paid

Dr. Income tax liability

Cr. Cash

Step 3

It is unlikely the actual charge will match the estimated liability so the tax liability account will be left with a closing balance carried forward. This needs be removed as the debt has been settled.

If there is an overprovision/overestimation in the prior year, it is adjusted as follows:

Dr. Income tax liability

Cr. Income tax charge

If there is an underestimate in the prior year, it is adjusted as follows:

Dr. Income tax charge

Cr. Income tax liability

The charge to the statement of profit or loss for current year as follows:

| $000 | |

| Current tax estimate | Xxx |

| Under/(over) provision in prior year | Xxx/(xxx) |

| Total income tax charge for the year | xxx |

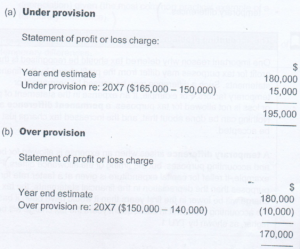

Example:

Simple has estimated its income tax liability for the year ended 31 December 20X8 at $180,000. In the previous year the income tax liability had been estimated as $150,000.

Required:

Calculate the tax charge that will be shown in the statement of profit and loss for the year ended 31 December 20X8 if the amount that was actually agreed and settled with tax authorities in respect of 20X7 was:

a. $165,000

b. $140,000

Source: Kaplan