Accounting Cycle for Service Company

Question

ABC Company is Service Company. Below are accounting transactions of ABC Company for closing monthly financial statements.

Please read them carefully.

| Date of November | Financial Transactions | Amount ($) |

| 1 | ABC commenced business with cash………………… | 100,000 |

| 4 | ABC bought furniture paid by cash………………. | 36,000 |

| 6 | ABC provides service on credit to CBB, Customer……… | 10,000 |

| 7 | ABC Deposited Cash into bank…………………………. | 5,000 |

| 9 | ABC provides service to customer for cash…………… | 2,000 |

| 12 | ABC deposited cash into bank………………………… | 10,000 |

| 14 | ABC paid advertisement by cheque………………… | 7,800 |

| 16 | ABC received cash from CBB, Customer………….. | 7,000 |

| Discount allowed to CBB, Customer………………. | 3,000 | |

| 17 | ABC received interest through bank……………. | 10 |

| 18 | Cash taken by owners for own use……………….. | 12,000 |

| 30 | ABC paid salary expenses as cash for employees…. | 20,000 |

| 30 | ABC paid for rent expense……………………………… | 11,000 |

We assume that fixed asset (furniture) bought at1 November has useful life 3 years.

Utilities expenses are estimated $500 even if invoice will be issued next month (December).

Required:

- Prepare General Journal

- Prepare General Ledger

- Prepare Trial Balance

- Make Adjusting Entry

- Prepare Adjusted Trial Balance

- Prepare income statement

- Statement of Change in Equity

- Prepare balance sheet

- Make closing entry

- Prepare Post (After) Closing Trial Balance

Solution

1.Prepare General Journal

Below is general journal for transactions above.

| Date | Explanation | Debit | Credit | |||||

| 1-Nov | Cash on hand | 100,000 | ||||||

| Capital | 100,000 | |||||||

| Capital investment | ||||||||

| 1-Nov | Fixed asset, Furniture | 36,000 | ||||||

| Cash on hand | 36,000 | |||||||

| Buy fixed asset | ||||||||

| 6-Nov | Account Receivable | 10,000 | ||||||

| Service Revenue | 10,000 | |||||||

| Provide service on credit | ||||||||

| 7-Nov | Cash at Bank | 5,000 | ||||||

| Cash on hand | 5,000 | |||||||

| Deposit cash at bank | ||||||||

| 9-Nov | Cash on hand | 2,000 | ||||||

| Service Revenue | 2,000 | |||||||

| Provide service for cash | ||||||||

| 12-Nov | Cash at Bank | 10,000 | ||||||

| Cash on hand | 10,000 | |||||||

| Deposit cash at bank | ||||||||

| 14-Nov | Advertising Expense | 7,800 | ||||||

| Cash at bank | 7,800 | |||||||

| Advertising for Company | ||||||||

| 16-Nov | Cash on hand | 7,000 | ||||||

| Discount Allowed | 3,000 | |||||||

| Account Receivable | 10,000 | |||||||

| Received cash & Discount for | CBB | |||||||

| 17-Nov | Cash at Bank | 10 | ||||||

| Interest Revenue | 10 | |||||||

| Received interest from bank | ||||||||

| 18-Nov | Drawing | 12,000 | ||||||

| Cash on hand | 12,000 | |||||||

| Owner withdraw for personal | use | |||||||

| 30-Nov | Salary expense | 20,000 | ||||||

| Cash on hand | 20,000 | |||||||

| Salary for November | ||||||||

| 30-Nov | Rental Expense | 11,000 | ||||||

| Cash on hand | 11,000 | |||||||

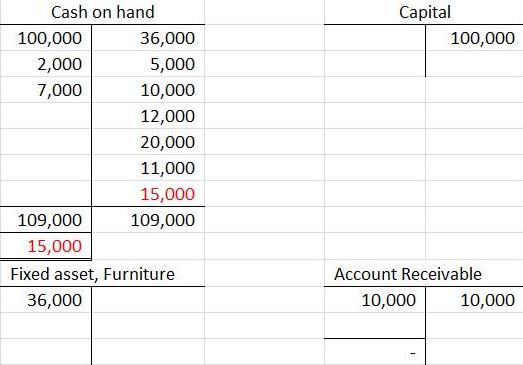

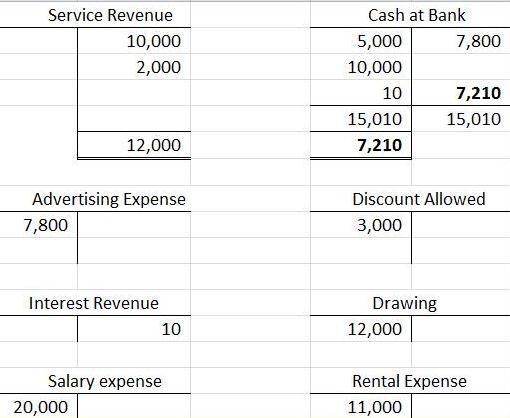

2.Prepare General Ledger

Below is general ledger after we prepared general journal above.

3.Trial Balance

Below is trial balance after preparing general ledger, so data and information we toke from general ledger.

| ABC Company | ||

| Adjusted Trial Balance | ||

| 30-Nov-15 | ||

| Debit | Credit | |

| Cash on hand | 15,000 | |

| Capital | 100,000 | |

| Fixed asset, Furniture | 36,000 | |

| Service Revenue | 12,000 | |

| Cash at Bank | 7,210 | |

| Advertising Expense | 7,800 | |

| Discount Allowed | 3,000 | |

| Interest Revenue | 10 | |

| Drawing | 12,000 | |

| Salary expense | 20,000 | |

| Rental Expense | 11,000 | |

| Total | 112,010 | 112,010 |

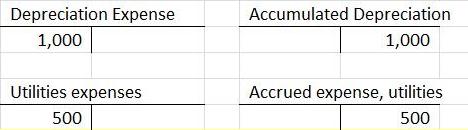

4. Adjusting Entry

Below is adjusting entry, so after we prepared trial balance, next step we will prepare adjusting entries for depreciation expense, accrual expense etc.

| 1. Depreciation Expense on Fixed asset | |||

| Furniture | 36,000 | ||

| Useful Life ( 3 year=36 months) | 36 | ||

| Depreciation Expense | 1,000 | 36,000/36 | |

| Dr. Depreciation Expense | 1,000 | ||

| Cr. Accumulated Depreciation | 1,000 | ||

| 2. Accrued Expense | |||

| Dr. Utilities expenses | 500 | ||

| Cr. Accrued expense, utilities | 500 | ||

5. Adjusted Trial Balance

Below is adjusted trial balance after we prepared adjusting entry, we will take data and information from Trial Balance and adjusting entry to prepare adjusted trial balance.

| ABC Company | ||

| Adjusted Trial Balance | ||

| 30-Nov-15 | ||

| Debit | Credit | |

| Cash on hand | 15,000 | |

| Capital | 100,000 | |

| Fixed asset, Furniture | 36,000 | |

| Service Revenue | 12,000 | |

| Cash at Bank | 7,210 | |

| Advertising Expense | 7,800 | |

| Discount Allowed | 3,000 | |

| Interest Revenue | 10 | |

| Drawing | 12,000 | |

| Salary expense | 20,000 | |

| Rental Expense | 11,000 | |

| Depreciation Expense | 1,000 | |

| Accumulated Depreciation | 1,000 | |

| Utilities expenses | 500 | |

| Accrued expense, utilities | 500 | |

| Total | 113,510 | 113,510 |

6. Income Statement

This is income statement that we will prepare after preparing adjusted trial balance, so we cannot prepare financial statements without adjusted trial balance.

| ABC Company | |||

| Income Statement | |||

| 30-Nov-15 | |||

| Revenue | |||

| Service Revenue | 12,000 | ||

| Interest Revenue | 10 | ||

| Total revenue | 12,010 | ||

| Expense : | |||

| Advertising Expense | 7,800 | ||

| Discount Allowed | 3,000 | ||

| Salary expense | 20,000 | ||

| Rental Expense | 11,000 | ||

| Depreciation Expense | 1,000 | ||

| Utilities expenses | 500 | ||

| Total Expense | 43,300 | ||

| Net profit (loss) | (31,290) | ||

7. Statement of Change in Equity

This is statement of Change in Equity that we will prepare after preparing adjusted trial balance and income statement, so we cannot prepare Statement of Change in Equity without adjusted trial balance and Income Statement.

| ABC Company | |||

| Statement of Change in Capital | |||

| 30-Nov-15 | |||

| Beginning Capital | 100,000 | ||

| Drawing | (12,000) | ||

| Net Loss | (31,290) | ||

| Ending Capital | 56,710 | ||

8. Balance Sheet

This is balance sheet ( statement of financial position) that we will prepare after preparing adjusted trial balance, income statement and statement of change in equity, so we cannot prepare balance sheet without adjusted trial balance and Income Statement.

| ABC Company | |||

| Balance Sheet | |||

| 30-Nov-15 | |||

| Non Current Asset | |||

| Furniture | 36,000 | ||

| Accumulated depreciation | (1,000) | ||

| 35,000 | |||

| Current Asset | |||

| Cash on Hand | 15,000 | ||

| Cash at Bank | 7,210 | ||

| 22,210 | |||

| Total Asset | 57,210 | ||

| Capital | 56,710 | ||

| Liability | |||

| Accrued Expense | 500 | ||

| Total Capital and Liability | 57,210 | ||

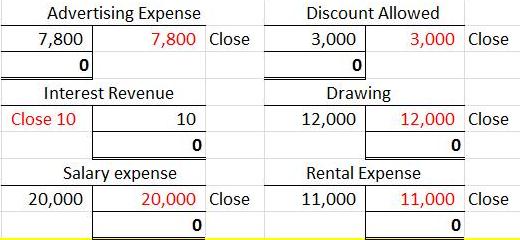

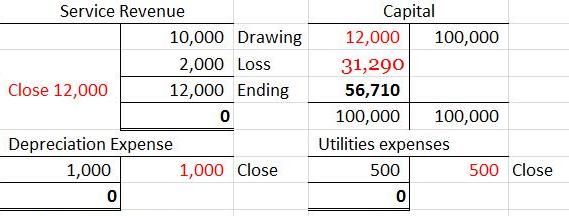

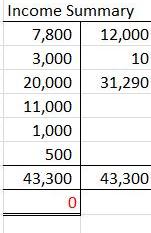

9. Closing Entry

below is closing entry that we will prepare after we prepared financial statements ( income statement, balance sheet, statement of change in equity, balance sheet etc.), so we will close temporary accounts such as income , expense etc. We will close account types such as revenues, expenses, profit/loss (income summary) and drawing.

| Revenue: | ||||

| Dr. service revenue | 12,000 | |||

| Cr. Income Summary | 12,000 | |||

| Dr. Interest revenue | 10 | |||

| Cr. Income Summary | 10 | |||

| Expenses: | ||||

| Dr. Income Summary | 7,800 | |||

| Cr. Advertising Expense | 7,800 | |||

| Dr. Income summary | 3,000 | |||

| Cr. Discount allowed | 3,000 | |||

| Dr. Income summary | 20,000 | |||

| Cr. Salary expense | 20,000 | |||

| Dr. Income Summary | 11,000 | |||

| Cr. Rental Expense | 11,000 | |||

| Dr. Income summary | 1,000 | |||

| Cr. Depreciation Expense | 1,000 | |||

| Dr. Income summary | 500 | |||

| Cr. Utilities Expense | 500 | |||

| Net Loss/Income Summary | ||||

| Dr. Capital | 31,290 | |||

| Cr. Income summary | 31,290 | |||

| Drawing | ||||

| Dr. Capital | 12,000 | |||

| Cr. Drawing | 12,000 | |||

10. Post (After) Closing Trial Balance

Below is closing trial balance that we will prepare after closing entry and financial statements , so we will use these accounts ( permanent accounts) for next accounting period. In sort, closing Trial Balance token from Balance Sheet Accounts.

| ABC Company | ||

| Post (After) Closing Trial Balance | ||

| 30-Nov-15 | ||

| Debit | Credit | |

| Cash on hand | 15,000 | |

| Capital | 56,710 | |

| Fixed asset, Furniture | 36,000 | |

| Cash at Bank | 7,210 | |

| Accumulated Depreciation | 1,000 | |

| Accrued expense, utilities | 500 | |

| Total | 58,210 | 58,210 |

We keep only account types such as assets, liabilities and capital for using next period.