The figures are filled in these tax forms explained at end of tax forms.

Assume we will declare monthly tax for September 2018, so the following steps will fill to submit to tax officer.

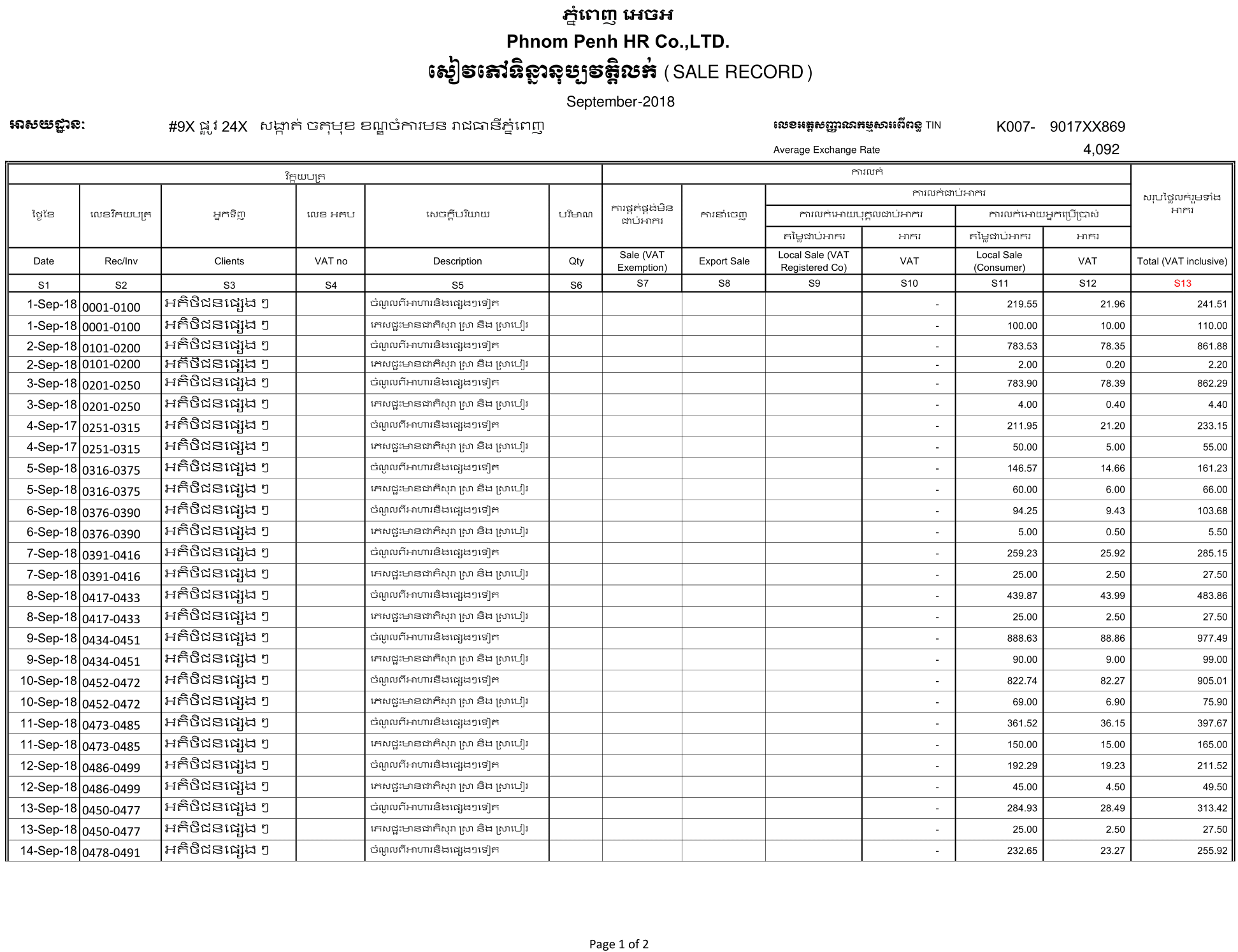

1.We will record sale for September 2018 the same as table below.

Information included Date, Invoice Number, Client (customers), VAT No. , Description, Quantity (Qty) Sold etc.

——

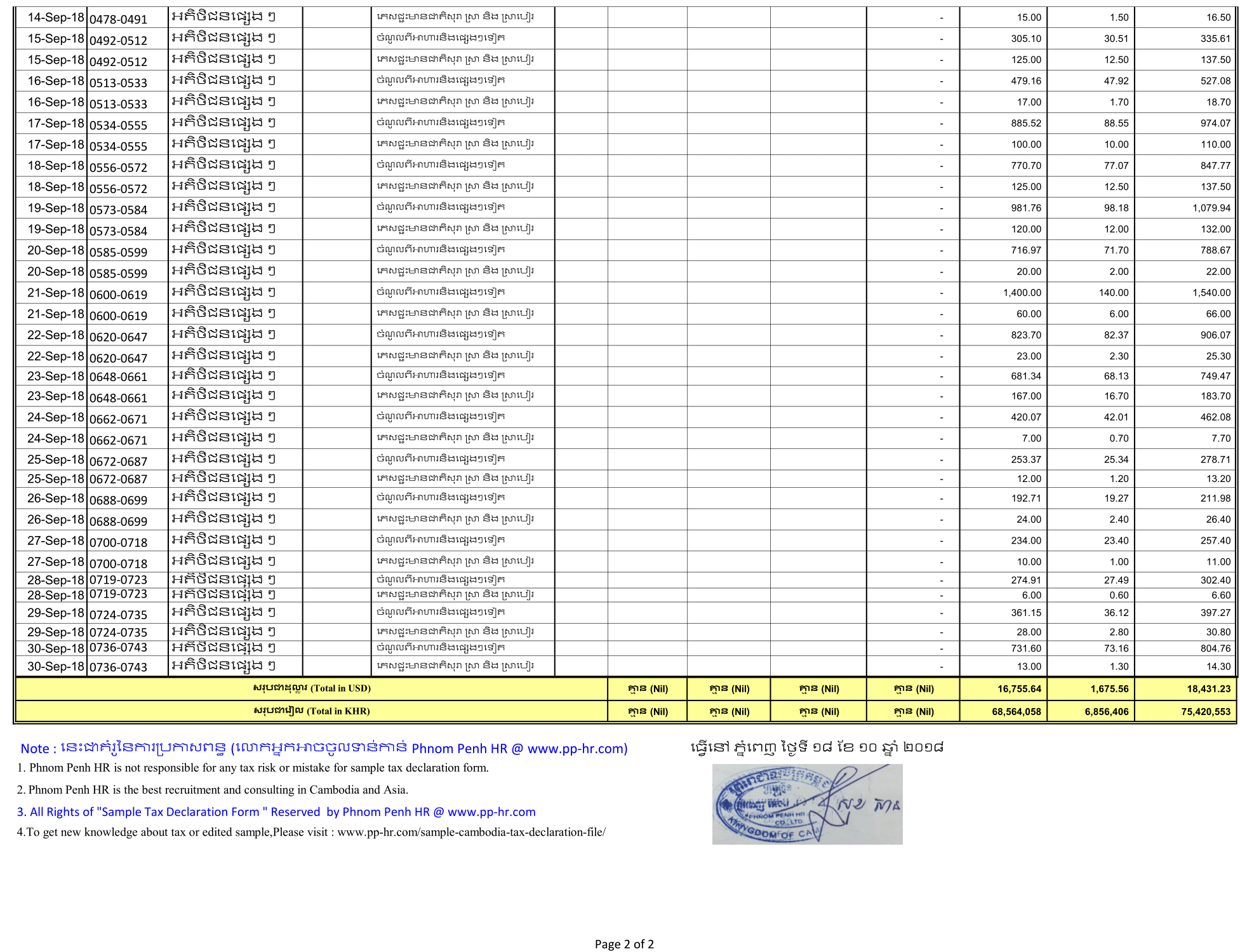

2.We will record salary for September 2018 the same as table below.

Information included Employee Names,Nationality,Functions, Salary , Spouse, Minor Children etc.

———

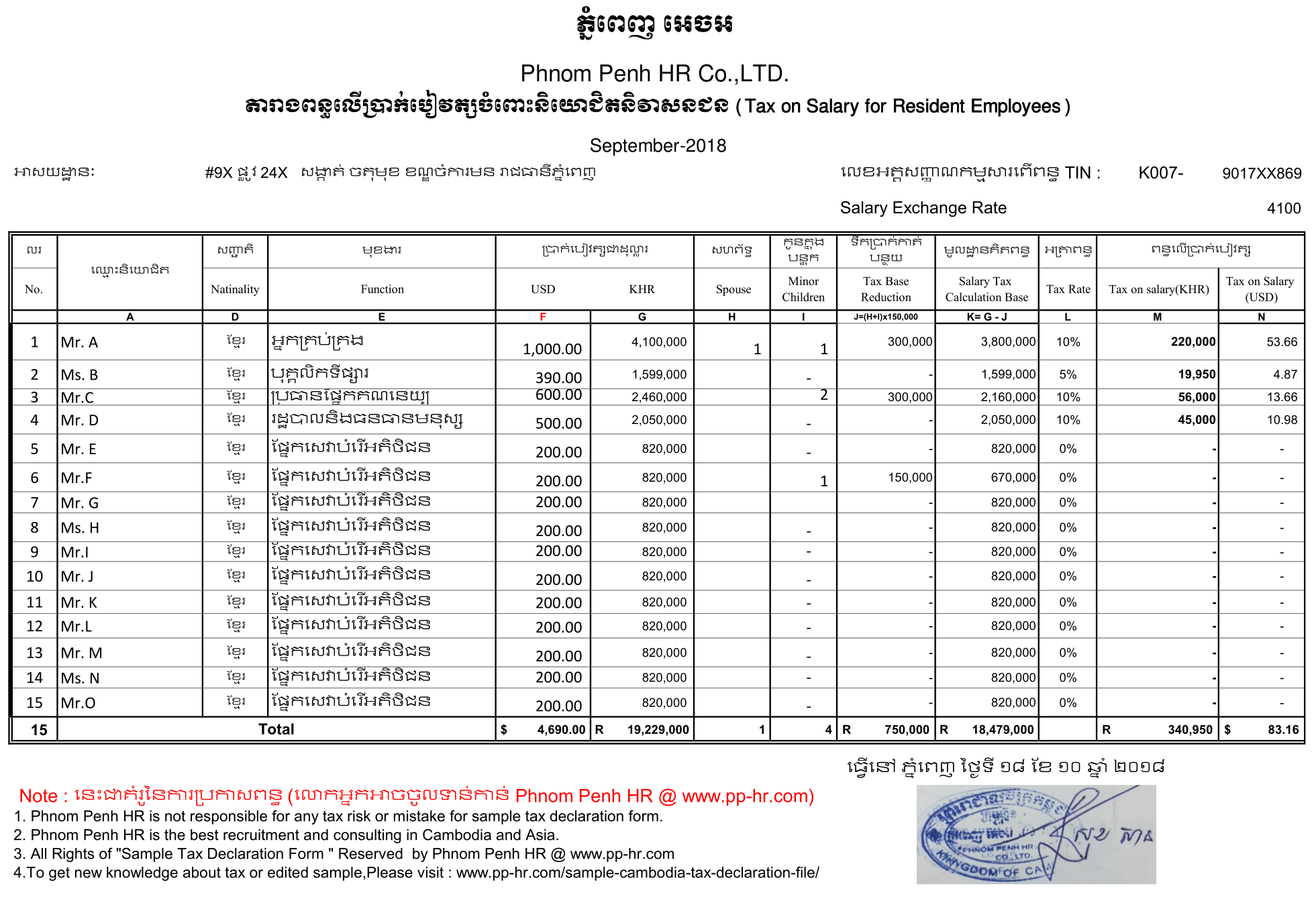

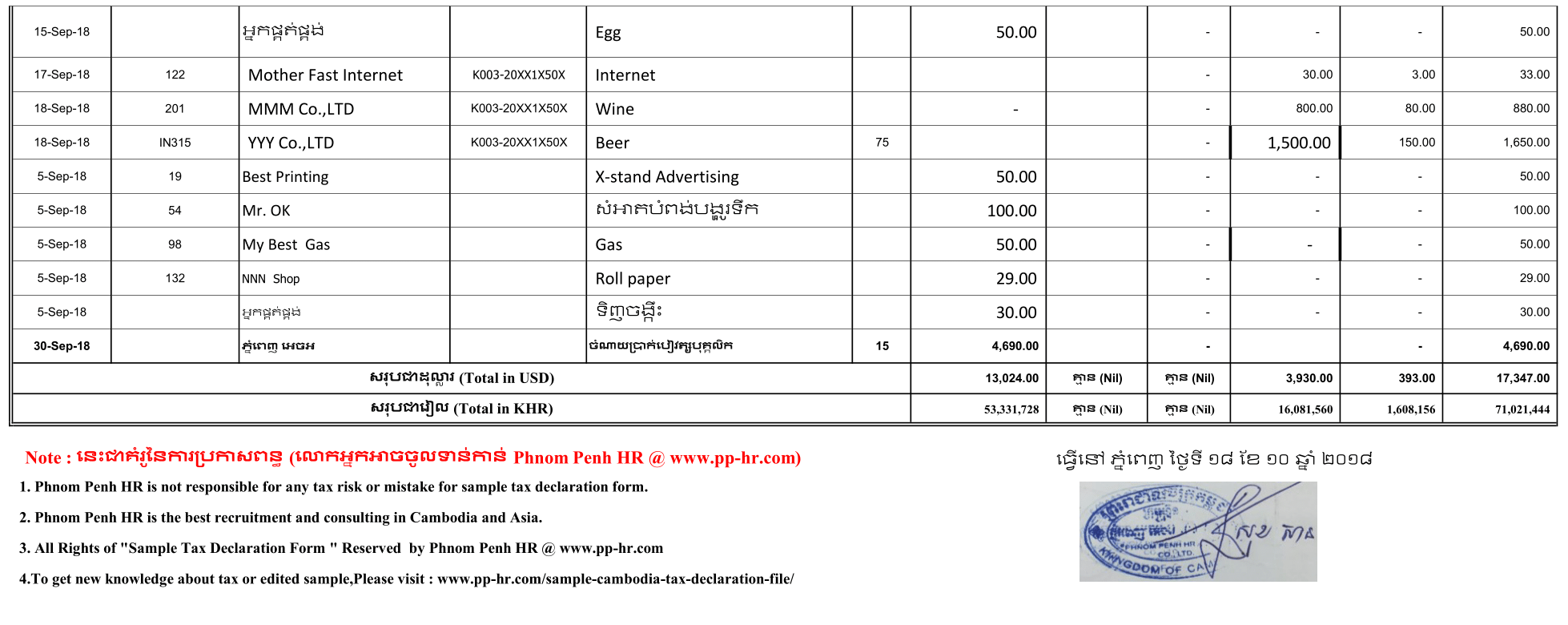

3.We will record purchase and expense for September 2018 the same as table below.

Information included Date, Invoice Number,Suppliers Name, VAT No. , Description, Quantity (Qty) purchased etc.

——

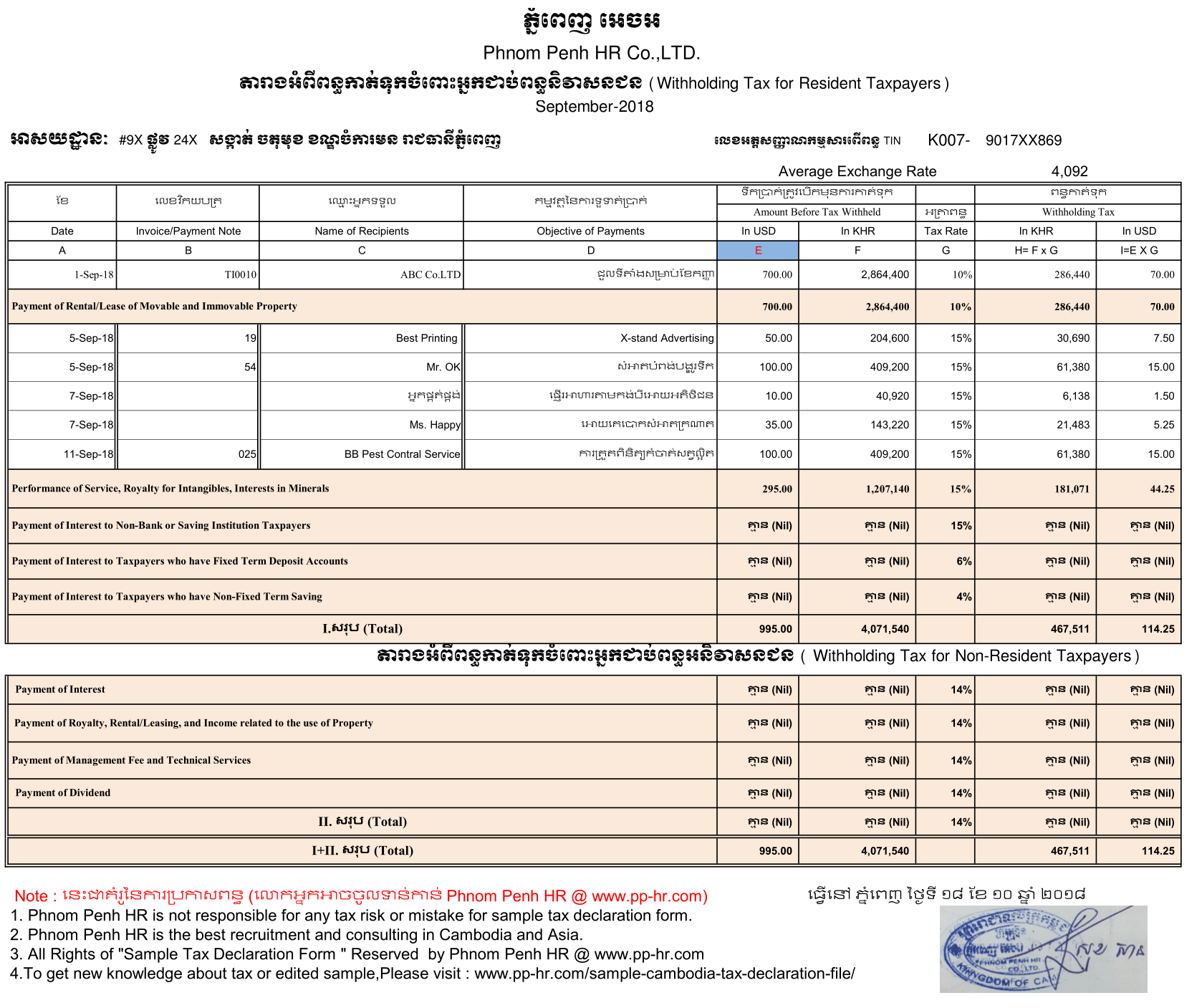

4.We will record withholding tax information for September 2018 the same as table below.

Information included Date, Invoice Number, Name of Recipient, Objective of Payment etc.

——

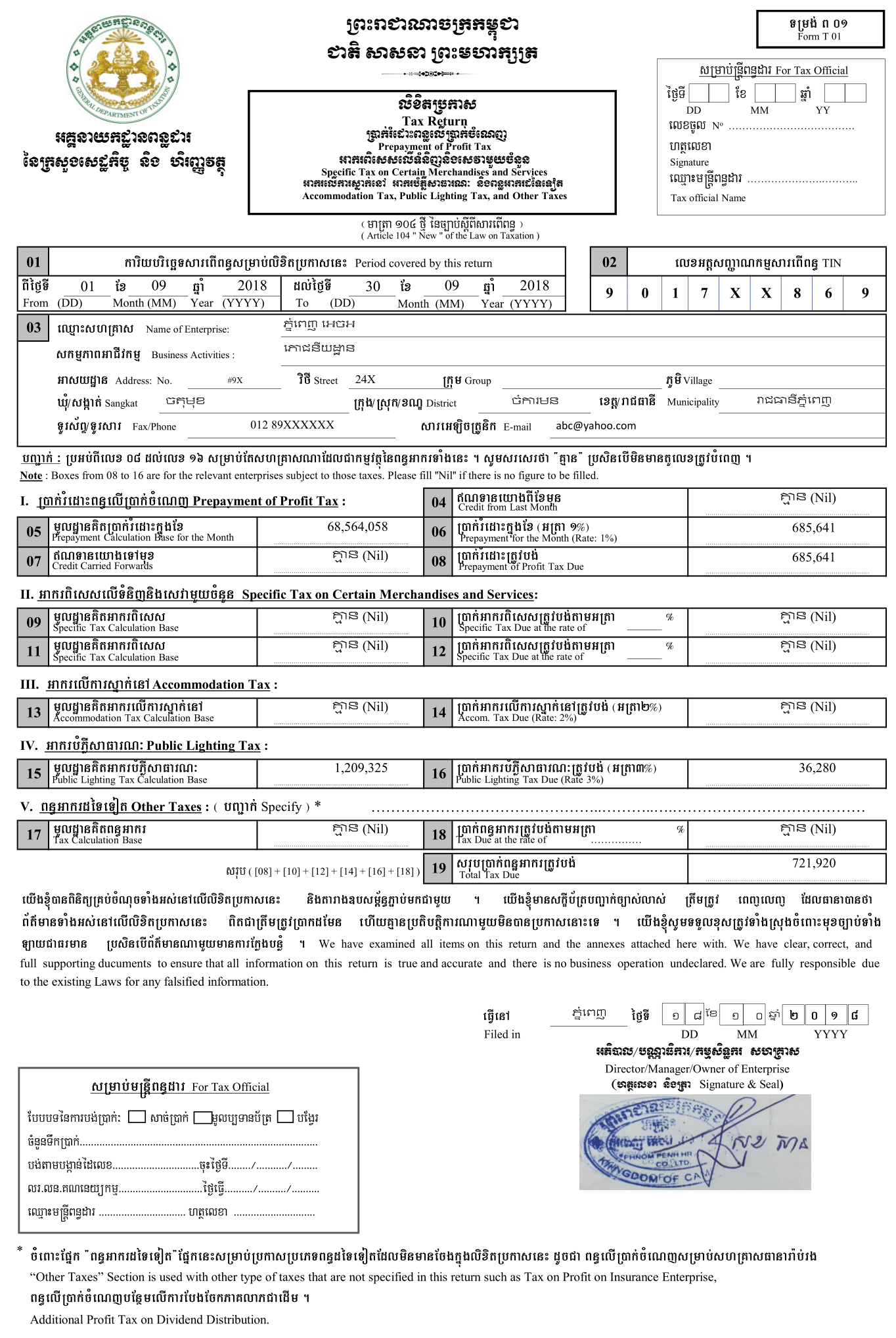

5.We will fill sale information above for September 2018 the same as tax Form T 01 below.

Taxes for Form T 01 included Prepayment of Profit Tax, Specific tax on certain merchandises and services, accommodation tax, pubic lighting tax etc.

——

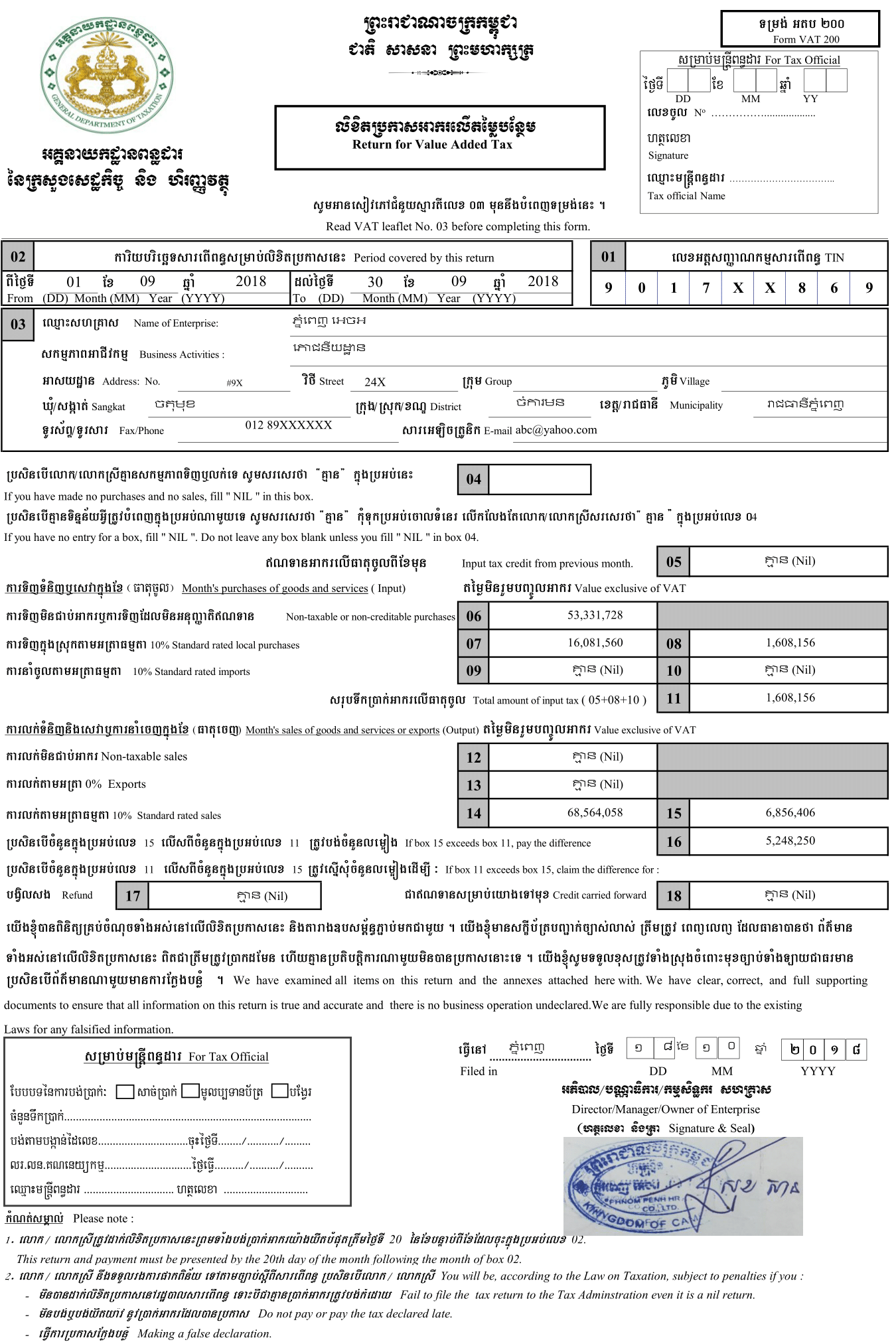

6.We will fill sale and purchase information above for September 2018 the same as tax Form VAT 200 below.

Information for Form VAT 200 included Input Tax Credit from Previous Month ( beginning VAT credit), VAT input during month , VAT output during month etc.

——

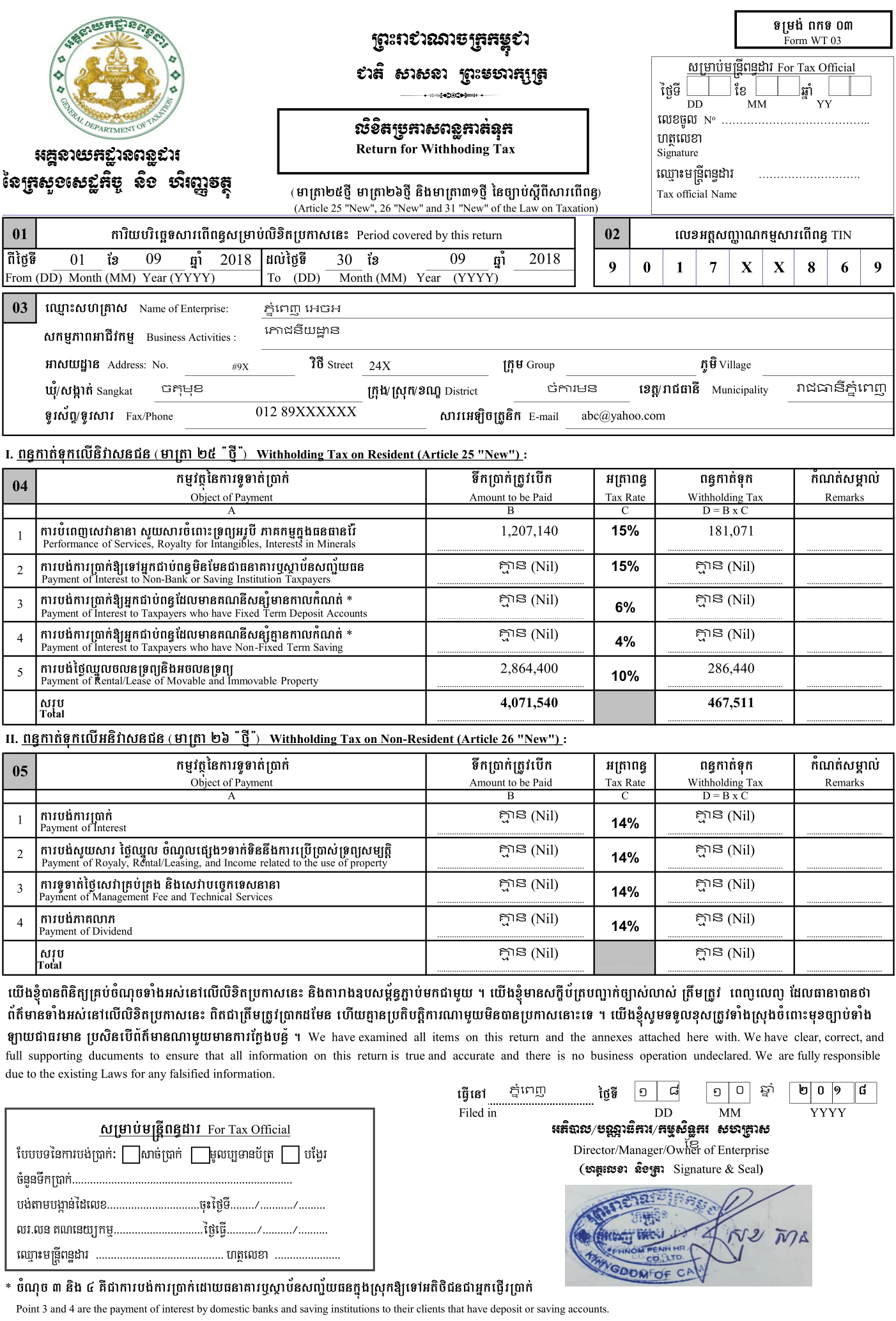

7.We will fill expense information relevant to withholding above for September 2018 the same as tax Form WH 03 below.

Taxes for WH 03 included withholding tax on resident ,withholding tax on non-resident etc.

——

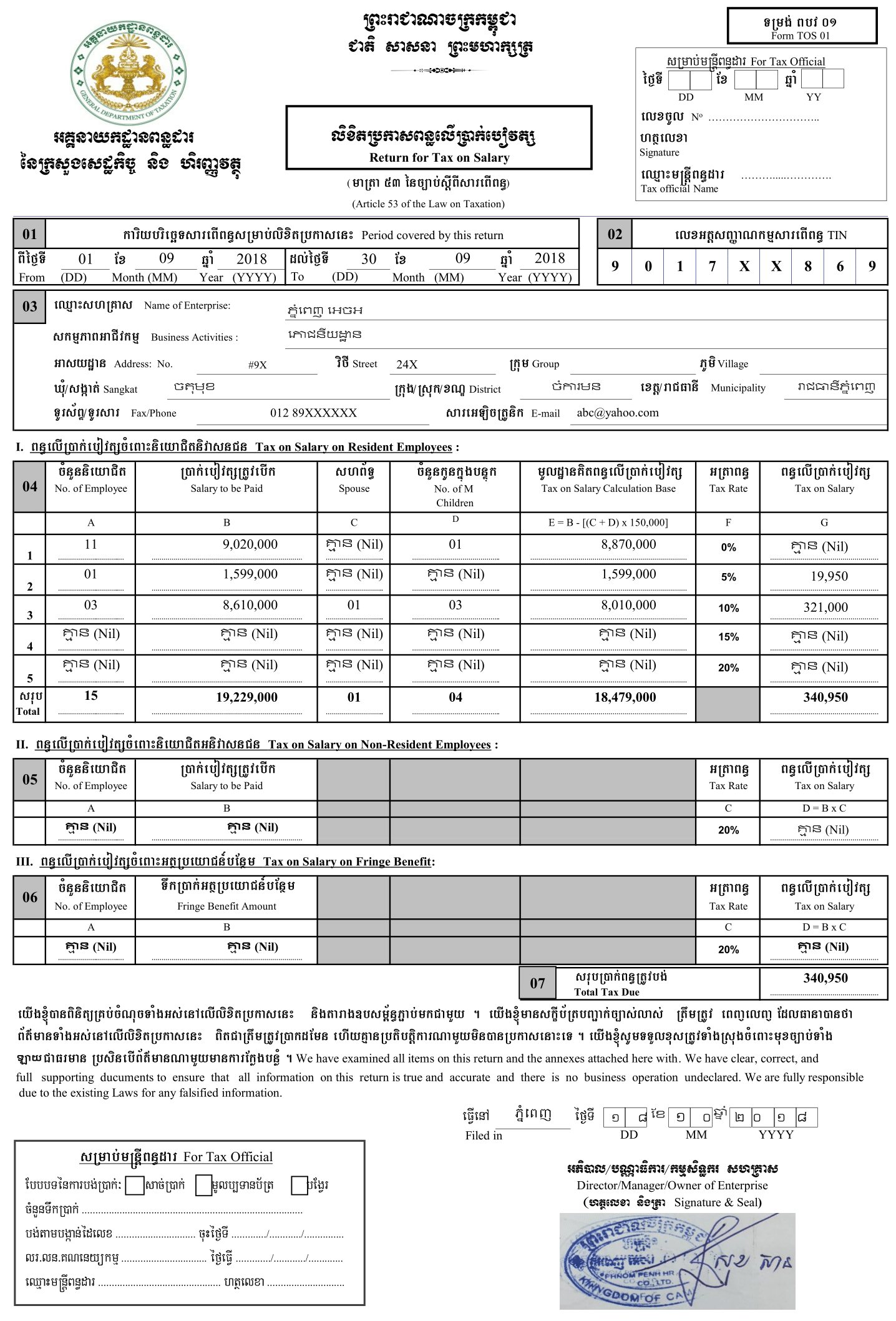

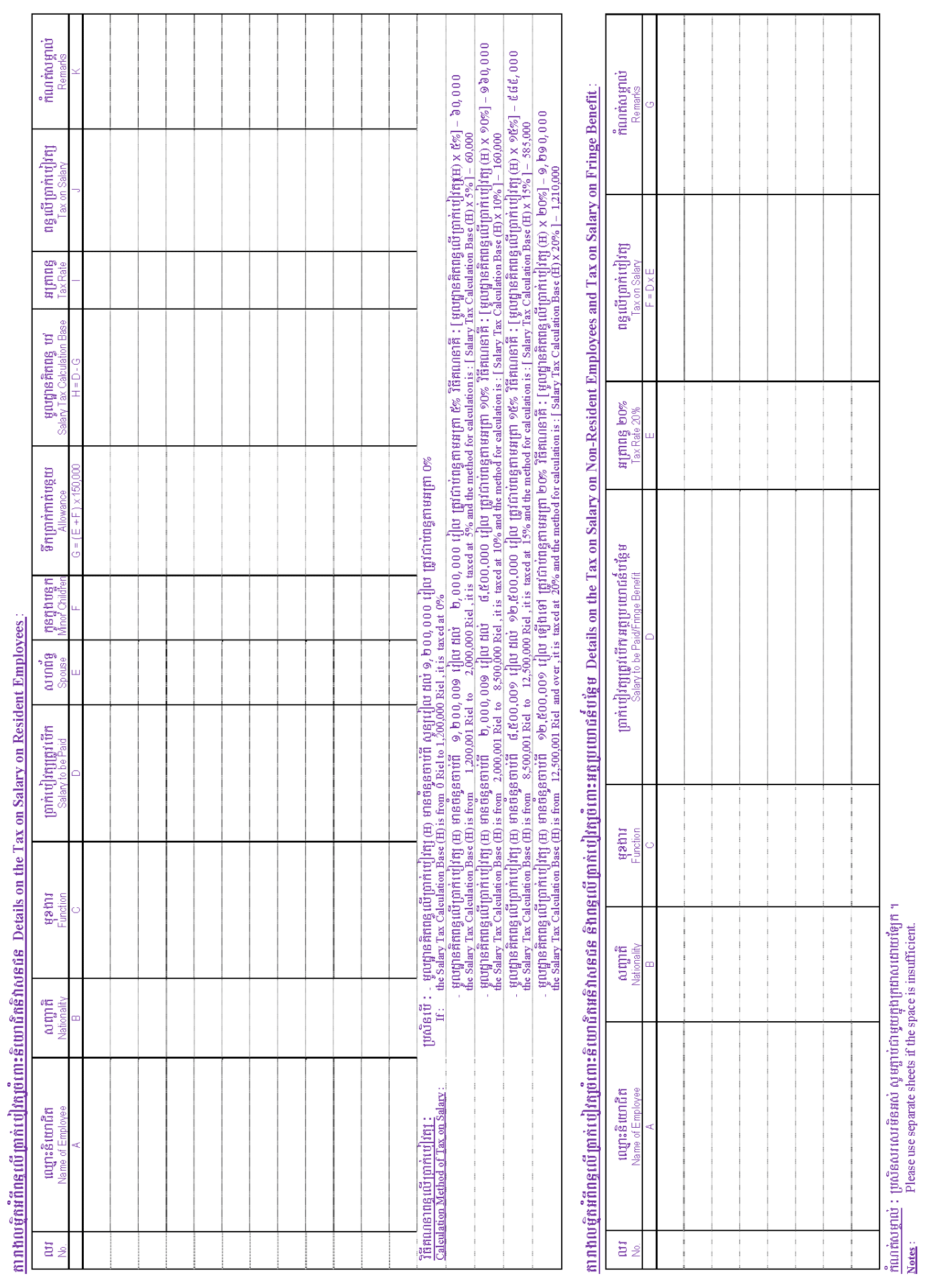

8.We will fill salary information for September 2018 the same as tax Form TOS 01 below.

Taxes for Form TOS 01 included tax on salary on resident Employees , Tax on salary on non-resident Employees etc.

——

Below are explained about figures filled in tax forms above.

Phnom Penh HR is best restaurant company in Cambodia. The following transactions for monthly tax declaration of September 2018 are as follows.

Sale Information:

– September 1, 2018 In# 0001-0100 and sale from foods, meal and other sale for amount including VAT of 241.51 $.

– September 1, 2018 In# 0001-0100 and sale from alcoholic beverages, wine and beer for amount including VAT of 110 $.

– September 2, 2018 In# 0101-0200 and sale from foods, meal and other sale for amount including VAT of 861.88 $.

– September 2, 2018 In# 0101-0200 and sale from alcoholic beverages, wine and beer for amount including VAT of 2.2 $.

– September 3, 2018 In# 0201-0250 and sale from foods, meal and other sale for amount including VAT of 862.285 $.

– September 3, 2018 In# 0201-0250 and sale from alcoholic beverages, wine and beer for amount including VAT of 4.4 $.

– September 4, 2017 In# 0251-0315 and sale from foods, meal and other sale for amount including VAT of 233.15 $.

– September 4, 2017 In# 0251-0315 and sale from alcoholic beverages, wine and beer for amount including VAT of 55 $.

– September 5, 2018 In# 0316-0375 and sale from foods, meal and other sale for amount including VAT of 161.23 $.

– September 5, 2018 In# 0316-0375 and sale from alcoholic beverages, wine and beer for amount including VAT of 66 $.

– September 6, 2018 In# 0376-0390 and sale from foods, meal and other sale for amount including VAT of 103.68 $.

– September 6, 2018 In# 0376-0390 and sale from alcoholic beverages, wine and beer for amount including VAT of 5.5 $.

– September 7, 2018 In# 0391-0416 and sale from foods, meal and other sale for amount including VAT of 285.145 $.

– September 7, 2018 In# 0391-0416 and sale from alcoholic beverages, wine and beer for amount including VAT of 27.5 $.

– September 8, 2018 In# 0417-0433 and sale from foods, meal and other sale for amount including VAT of 483.86 $.

– September 8, 2018 In# 0417-0433 and sale from alcoholic beverages, wine and beer for amount including VAT of 27.5 $.

– September 9, 2018 In# 0434-0451 and sale from foods, meal and other sale for amount including VAT of 977.49 $.

– September 9, 2018 In# 0434-0451 and sale from alcoholic beverages, wine and beer for amount including VAT of 99 $.

– September 10, 2018 In# 0452-0472 and sale from foods, meal and other sale for amount including VAT of 905.01 $.

– September 10, 2018 In# 0452-0472 and sale from alcoholic beverages, wine and beer for amount including VAT of 75.9 $.

– September 11, 2018 In# 0473-0485 and sale from foods, meal and other sale for amount including VAT of 397.665 $.

– September 11, 2018 In# 0473-0485 and sale from alcoholic beverages, wine and beer for amount including VAT of 165 $.

– September 12, 2018 In# 0486-0499 and sale from foods, meal and other sale for amount including VAT of 211.52 $.

– September 12, 2018 In# 0486-0499 and sale from alcoholic beverages, wine and beer for amount including VAT of 49.5 $.

– September 13, 2018 In# 0450-0477 and sale from foods, meal and other sale for amount including VAT of 313.42 $.

– September 13, 2018 In# 0450-0477 and sale from alcoholic beverages, wine and beer for amount including VAT of 27.5 $.

– September 14, 2018 In# 0478-0491 and sale from foods, meal and other sale for amount including VAT of 255.92 $.

– September 14, 2018 In# 0478-0491 and sale from alcoholic beverages, wine and beer for amount including VAT of 16.5 $.

– September 15, 2018 In# 0492-0512 and sale from foods, meal and other sale for amount including VAT of 335.61 $.

– September 15, 2018 In# 0492-0512 and sale from alcoholic beverages, wine and beer for amount including VAT of 137.5 $.

– September 16, 2018 In# 0513-0533 and sale from foods, meal and other sale for amount including VAT of 527.08 $.

– September 16, 2018 In# 0513-0533 and sale from alcoholic beverages, wine and beer for amount including VAT of 18.7 $.

– September 17, 2018 In# 0534-0555 and sale from foods, meal and other sale for amount including VAT of 974.07 $.

– September 17, 2018 In# 0534-0555 and sale from alcoholic beverages, wine and beer for amount including VAT of 110 $.

– September 18, 2018 In# 0556-0572 and sale from foods, meal and other sale for amount including VAT of 847.765 $.

– September 18, 2018 In# 0556-0572 and sale from alcoholic beverages, wine and beer for amount including VAT of 137.5 $.

– September 19, 2018 In# 0573-0584 and sale from foods, meal and other sale for amount including VAT of 1079.94 $.

– September 19, 2018 In# 0573-0584 and sale from alcoholic beverages, wine and beer for amount including VAT of 132 $.

– September 20, 2018 In# 0585-0599 and sale from foods, meal and other sale for amount including VAT of 788.67 $.

– September 20, 2018 In# 0585-0599 and sale from alcoholic beverages, wine and beer for amount including VAT of 22 $.

– September 21, 2018 In# 0600-0619 and sale from foods, meal and other sale for amount including VAT of 1540 $.

– September 21, 2018 In# 0600-0619 and sale from alcoholic beverages, wine and beer for amount including VAT of 66 $.

– September 22, 2018 In# 0620-0647 and sale from foods, meal and other sale for amount including VAT of 906.07 $.

– September 22, 2018 In# 0620-0647 and sale from alcoholic beverages, wine and beer for amount including VAT of 25.3 $.

– September 23, 2018 In# 0648-0661 and sale from foods, meal and other sale for amount including VAT of 749.465 $.

– September 23, 2018 In# 0648-0661 and sale from alcoholic beverages, wine and beer for amount including VAT of 183.7 $.

– September 24, 2018 In# 0662-0671 and sale from foods, meal and other sale for amount including VAT of 462.075 $.

– September 24, 2018 In# 0662-0671 and sale from alcoholic beverages, wine and beer for amount including VAT of 7.7 $.

– September 25, 2018 In# 0672-0687 and sale from foods, meal and other sale for amount including VAT of 278.71 $.

– September 25, 2018 In# 0672-0687 and sale from alcoholic beverages, wine and beer for amount including VAT of 13.2 $.

– September 26, 2018 In# 0688-0699 and sale from foods, meal and other sale for amount including VAT of 211.975 $.

– September 26, 2018 In# 0688-0699 and sale from alcoholic beverages, wine and beer for amount including VAT of 26.4 $.

– September 27, 2018 In# 0700-0718 and sale from foods, meal and other sale for amount including VAT of 257.4 $.

– September 27, 2018 In# 0700-0718 and sale from alcoholic beverages, wine and beer for amount including VAT of 11 $.

– September 28, 2018 In# 0719-0723 and sale from foods, meal and other sale for amount including VAT of 302.4 $.

– September 28, 2018 In# 0719-0723 and sale from alcoholic beverages, wine and beer for amount including VAT of 6.6 $.

– September 29, 2018 In# 0724-0735 and sale from foods, meal and other sale for amount including VAT of 397.27 $.

– September 29, 2018 In# 0724-0735 and sale from alcoholic beverages, wine and beer for amount including VAT of 30.8 $.

– September 30, 2018 In# 0736-0743 and sale from foods, meal and other sale for amount including VAT of 804.76 $.

– September 30, 2018 In# 0736-0743 and sale from alcoholic beverages, wine and beer for amount including VAT of 14.3 $.

Salary Information :

– Mr. A , nationality as Khmer , position as manager , salary of $1,000 , wife is housewife and one minor child.

– Ms. B , nationality as Khmer , position as sale officer , salary of $390 .

– Mr.C , nationality as Khmer , position as accounting manager , salary of $600 and has two minor children.

– Mr. D , nationality as Khmer , position as HR and Admin officer , salary of $500 .

– Mr. E , nationality as Khmer , position as customer service , salary of $200 .

– Mr.F , nationality as Khmer , position as customer service , salary of $200 , has one minor child.

– Mr. G , nationality as Khmer , position as customer service , salary of $200 .

– Ms. H , nationality as Khmer , position as customer service , salary of $200 .

– Mr.I , nationality as Khmer , position as customer service , salary of $200 .

– Mr. J , nationality as Khmer , position as customer service , salary of $200 .

– Mr. K , nationality as Khmer , position as customer service , salary of $200 .

– Mr.L , nationality as Khmer , position as customer service , salary of $200 .

– Mr. M , nationality as Khmer , position as customer service , salary of $200 .

– Ms. N , nationality as Khmer , position as customer service , salary of $200 .

– Mr.O , nationality as Khmer , position as customer service , salary of $200 .

Purchase and Expense information:

– September 1, 2018 , invoice from supplier TI0010 , supplier name ABC Co.LTD , supplier VAT Number K007-10XXXX403 , and expense for rental of $770.00 .

– September 7, 2018 , invoice from supplier 8XXXX05 , supplier name Electricite Du Cambodge , and expense for electricity of $100.00 .

– September 7, 2018 , invoice from supplier 234 , supplier name XYZ , and expense for ingredients of $170.00 .

– September 7, 2018 , supplier name other supplier , and expense for tuk tuk of $10.00 .

– September 7, 2018 , supplier name Cellcard , and expense for phone card of $10.00 .

– September 7, 2018 , supplier name Ms. Happy , and expense for clothes washing of $35.00 .

– September 7, 2018 , invoice from supplier 101 , supplier name AAA , and expense for ice of $100.00 .

– September 8, 2018 , invoice from supplier 120 , supplier name A Good Rice , and expense for rice of $5,000.00 .

– September 8, 2018 , invoice from supplier 12 , supplier name other supplier , and expense for meatball of $200.00 .

– September 9, 2018 , supplier name other supplier , and expense for Vegetables of $400.00 .

– September 10, 2018 , invoice from supplier 17 , supplier name other supplier , and expense for Dishes of $150.00 .

– September 10, 2018 , invoice from supplier 12XXX , supplier name AA Beverage Company.Co.,Ltd , supplier VAT Number L003-10XXXX404 , and expense for Beverages of $770.00 .

– September 11, 2018 , invoice from supplier PPWSA18XXXXX8 , supplier name Phnom Penh Water Supply Authority , and expense for water supply of $50.00 .

– September 11, 2018 , invoice from supplier 025 , supplier name BB Pest Contral Service , and expense for Control of insect pests of $100.00 .

– September 13, 2018 , invoice from supplier 103 , supplier name other supplier , and expense for meat of $1,700.00 .

– September 14, 2018 , invoice from supplier 876 , supplier name XXX Tech Co.,Ltd , supplier VAT Number K003-10XX1X40X , and expense for Drinking water of $220.00 .

– September 15, 2018 , supplier name other supplier , and expense for Egg of $50.00 .

– September 17, 2018 , invoice from supplier 122 , supplier name Mother Fast Internet , supplier VAT Number K003-20XX1X50X , and expense for Internet of $33.00 .

– September 18, 2018 , invoice from supplier 201 , supplier name MMM Co.,LTD , supplier VAT Number K003-20XX1X50X , and expense for Wine of $880.00 .

– September 18, 2018 , invoice from supplier IN315 , supplier name YYY Co.,LTD , supplier VAT Number K003-20XX1X50X , and expense for Beer of $1,650.00 .

– September 5, 2018 , invoice from supplier 19 , supplier name Best Printing , and expense for X-stand Advertising of $50.00 .

– September 5, 2018 , invoice from supplier 54 , supplier name Mr. OK , and expense for cleaning drainage pipe of $100.00 .

– September 5, 2018 , invoice from supplier 98 , supplier name My Best Gas , and expense for Gas of $50.00 .

– September 5, 2018 , invoice from supplier 132 , supplier name NNN Shop , and expense for Roll paper of $29.00 .

– September 5, 2018 , supplier name other supplier , and expense for chopsticks of $30.00 .

Monthly Exchange Rate Information:

-Salary exchange rate for February: $1=4100 KHR

-Average Exchange rate for February: $1 =4092 KHR

Note:

-All of Sample Tax Declaration forms above are rights reserved by Phnom Penh HR, the best recruitment & consulting firm in Cambodia and Asia.

-In practice, Tax Declaration forms may be different styles.