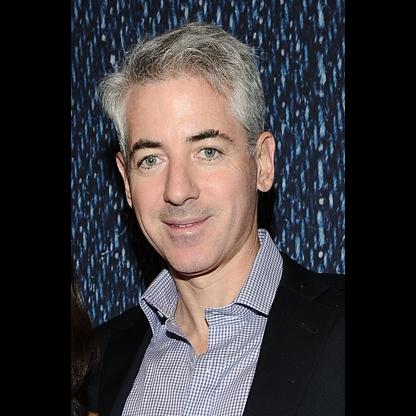

William Albert “Bill” Ackman (born May 11, 1966) is an American investor, hedge fund manager, and philanthropist. He is the founder and CEO of Pershing Square Capital Management, a hedge fund management company. Ackman is considered a contrarian investor[1][2] but he considers himself an activist investor.

His investing style and investments have drawn considerable critical praise and criticism from U.S. federal and state government officials, heads of other hedge funds, various retail investors, and the general public. Ackman’s most notable market plays include shorting MBIA’s bonds during the 2008 financial crisis, his proxy battle with Canadian Pacific Railway, as well as his stakes in the Target Corporation, Valeant Pharmaceuticals, and Chipotle Mexican Grill. He is currently engaged in his 2012 shorting attempt of Herbalife, claiming the company is a pyramid scheme designed as a multi-level marketing firm.

Early life and education

Ackman was raised in Chappaqua, New York, the son of Ronnie I. (née Posner) and Lawrence David Ackman, the chairman of a New York real estate financing firm, Ackman-Ziff Real Estate Group. His family is Jewish.

In 1988, he received a bachelor of arts degree magna cum laude in history from Harvard College. His thesis was “Scaling the Ivy Wall: the Jewish and Asian American Experience in Harvard Admissions.” In 1992, he received an MBA from Harvard Business School.

Summary

| Bill Ackman | |

|---|---|

| Born | William Albert Ackman May 11, 1966 |

| Residence | New York City, New York, U.S. |

| Nationality | American |

| Alma mater | Harvard University (MBA) (BA) |

| Occupation | Investor, hedge fund manager, and philanthropist |

| Known for | Leading Pershing Square Capital Management |

| Net worth | US$1.4 billion (February 2017) |

| Spouse(s) | Karen Herskovitz (m. 1994; div. 2017) |

| Children | 3 |

| Website | pershingsquarecapital.com |

- Bill Ackman founded and runs Pershing Square Capital Management.

- Ackman married Nexi Oxman, a professor in MIT’s Media Lab in January 2019, after finalizing his divorce from his longtime wife Karen.

- Ackman created Pershing Square in 2004 and rose to fame for his short of bond insurer MBIA and his rescue of mall operator General Growth.

- Coming out of the crisis, he at times topped Wall Street with activist wins on Canadian Pacific, Fortune Brands and Allergan.

- He hit hard times after trying to merge of Allergan and Valeant in 2014. He made over $1 billion on the former, but lost $3 billion on the latter.

Source: