THE DISCOUNTED PAYBACK

Discounted payback period is the length of time required for an investment’s discounted cash flows to equal its initial cost.

In general, if we use a discounted payback rule, we won’t accidentally take any projects with a negative estimated NPV, but this argument assume the cash flows, other than the first, are all positive. If they are not, then these statements are not necessarily correct. Also, there may be more than one discounted payback.

Advantages of discounted payback method:

- Includes time value of money

- Easy to understand

- Does not accept negative estimated NPV investments.

- Biased towards liquidity.

Disadvantages of discounted payback method:

- May reject positive NPV investment

- Requires an arbitrary cutoff point.

- Ignores cash flows beyond the cutoff date.

- Biased against long-term projects, such as research and development, and new projects.

Project Decision:

- if discounted payback period<cutoff period or number of prespecified year=> accept the project.

- if discounted payback period>cutoff period or number of prespecified year => reject the project.

Example:

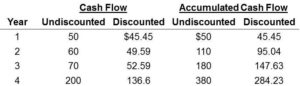

The proposed overseas expansion for project investment has the following cash flows:

You are required to solve the following issues.

- Payback;

- Discounted payback;

- Net Present Value ( NPV)

You may use a required return of 10 percent. Assume cutoff period of 3 years under discounted payback rule; is this project taken?

Solution:

- Payback period: payback occurs between years 3 and 4, so payback period=3+ ($20/200)=3.10 years.

- Discounted Payback Period: occurs between years 3 and 4, so discounted payback period=3+ (200-147.63)/136.6=3.38 years.

- Net Present Value: NPV= 284.23-200 =$84.23

Decision:

This project is evaluated using discounted payback method (not use payback and NPV). Discounted payback period of 3.38 years is greater than cutoff period of 3 years, so this project should be rejected.

Source:

- Phnom Penh HR

- Mcgraw-Hill – Fundamentals Of Corporate Finance