Investing Project

NPV= sum of present value of each cash inflow – initial investment

There are two types for sum of present value of each cash inflow :

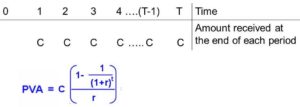

1.Annuity

2. Not Annuity

Project decision:

if NPV>0=> accept the project

if NPV<0=>reject the project

if NPV=0=>indifference

Advantage for NPV:

- it regards all period of project life in calculating.

- it considers the time value of invested fund.

Disadvantages for NPV:

- It is more difficult in calculating than payback period and ARR. Therefore, it can not be used by lower level staffs to support their decision.

- At the time of NPV equal 0 managers can choose other investment criteria to support their decision making.

Example:

Suppose fertilizer business earns cash revenue $20,000 per year, and cash cost (including taxes) will be $14,000 per year. We will wind down the business in eight years. The plant, property and equipment will be worth $2,000 as salvage at that time. The project costs $30,000 to launch. We use a 15 percent discount rate on new project. Is this a good investment? If there are 1,000 shares of stock outstanding , what will be the effect on the price per share of taking this investment?

Solution:

- Present Value

Present Value = C*{ [(1-1/(1+r)^t)]/r}+F/(1+r)^t

=$6,000*{ [(1 1/(1+0.15)^8)]/0.15}+$2,000/(1+0.15)^8 =$27,578

- Initial Investment

Initial investment =$30,000

NPV=$27,578 – $30,000=-$2,422<0

Therefore, this is not a good investment. Based on our estimates, taking it would decrease the total value of the stock by $2,422. with 1,000 shares outstanding, our best estimate of the impact of taking this project is a loss of value of $2,422/1,000=$2.42 per share.

Source:

- Mcgraw-Hill – Fundamentals Of Corporate Finance

- Phnom Penh HR