Financing Project

NPV= Cash receipt – sum of present value of each cash outflow

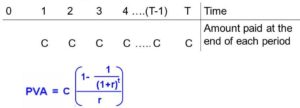

There are two types of sum of present value of each cash outflow:

Project decision:

- if NPV>0=> accept the project

- if NPV<0=>reject the project

- if NPV=0=>indifference

Example:

Suppose you are offered $5,000 today but must make the following payments.

Required

1.What is the NPV of the offer if the appropriate discount rate is 10 percent? 20 percent?

2.Should you accept this offer for separate discount rate?

Solution:

1.Calculation of NPV:

-Discount rate = 10%

NPV = 5,000 – 2,500/(1+0.1)^1 – 2,000/(1+0.1)^2

–1,000/(1+0.1)^3- 1,000/(1+0.1)^4= – $359.95

-Discount rate = 20%

NPV = 5,000 – 2,500/(1+0.1)^1 – 2,000/(1+0.1)^2

– 1,000/(1+0.1)^3- 1,000/(1+0.1)^4= $466.82

2. Offer decision:

-Discount rate = 10%

NPV = – $359.95 < 0 => reject this offer.

-Discount rate = 20%

NPV = $466.82 >0 => accept this offer.

Source:

- Mcgraw-Hill – Fundamentals Of Corporate Finance

- Phnom Penh HR