Internal Rate of Return (IRR) for Financing Project

Internal rate of return (IRR) is the discount rate that makes Net Present Value (NPV) of investment zero.

NPV= Cash receipt – sum of present value of each cash outflow when NPV= 0, so Cash receipt = sum of present value of each cash outflow

Investing project has only one IRR.

Project Decision:

– if IRR<discount rate => accept the project

– if IRR>discount rate => Reject the project

Example:

Your friend lends you $100, but you return back $130 to him next year.

| Dates: | 0 | 1 |

| Cash Flow | $100 | -$130 |

Required:

- Assume that interest rate at bank is 15%. Do you accept this offer?

- Build NPV profile/graph, and mention about financing project from your friend.

Solution:

- Accept or Reject this offer

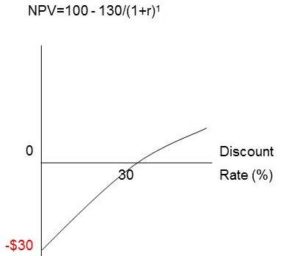

NPV=100-130/(1+r)^1

NPV=0, IRR = 30%

Decision:

IRR=30%

Discount rate = 15%

30%>15%, so reject this offer from him.

- Graph/profile

Financing project has a cash inflow at date 0 followed by a cash outflow at date 1.The NPV is negative when the discount rate is below 30 percent and otherwise.

When discount rate is less than 30%, we will reject this offer, so we should borrow bank instead.

When discount rate (borrowing rate) is greater than 30%, so we will borrow him.

Source:

- Phnom Penh HR

- Mcgraw-Hill – Fundamentals Of Corporate Finance